On the eve of American Independence Day, the United States released several weak economic data, adding to the signs of slow economic growth in the country and fueling expectations for interest rate cuts. For instance, the US June ISM services index came in at 48.8, which was unexpectedly far below the expected 52.6, marking the fastest contraction in four years and reversing the situation in May when the data rebounded to a nine-month high.

Additionally, the increase in unemployment benefit claims and the ADP employment data falling short of expectations indicate a cooling labor market. The initial jobless claims for the week ending June 29th rose to 238,000, hitting a new high since January of this year; the US June "small non-farm" ADP employment change added 150,000 jobs, significantly below the expected 165,000, marking the lowest level in four months.

Investors are optimistic about the prospects of a Federal Reserve rate cut, with the CME FedWatch Tool showing the possibility of a 25 basis point cut in September rising from 63% to 66.5%. Investors still anticipate at least one rate cut by the Federal Reserve this year. Following the data release, US Treasury yields and the dollar both declined, while gold prices rose, and strong gains in tech stocks propelled the S&P 500, Nasdaq, and Nasdaq 100 to new closing highs. Moreover, due to a sharp drawdown of over 12 million barrels in US EIA crude oil inventories, and the ongoing conflict between Israel and Hamas in the Gaza Strip maintaining the risk premium for crude oil futures, international oil prices closed up by more than 1%.

As Thursday is Independence Day in the United States, the US stock market will be closed all day, and it will close three hours early on Wednesday, ending at 1:00 AM Beijing time.

The subsequently released Federal Reserve meeting minutes revealed that there were differing opinions among officials at the June policy meeting about how long high interest rates should be maintained. Federal Reserve officials indicated that they are waiting for more evidence of cooling inflation. Although "some" officials emphasized the need for patience, "a few" participants specifically pointed out that further weakening in the labor market could lead to a more significant rise in the unemployment rate.

Internationally, due to weak demand, the momentum of economic expansion in the Eurozone has weakened. The Eurozone's June composite PMI final value of 50.9 slightly exceeded expectations but fell to a three-month low. At the same time, the Eurozone's May PPI continued its downward trend. European Central Bank Governing Council member and Governor of the Bank of Greece, Stournaras, stated that recent data slightly reinforced the possibility of continued rate cuts, and it seems reasonable to expect two more rate cuts this year. Even with two more rate cuts, the central bank's interest rates would still be at a restrictive level. There should be no over-interpretation of (Eurozone) service inflation.

Looking ahead, the UK will hold general elections on Thursday, and the US non-farm employment data will be released on Friday. Economists expect non-farm employment, including both the private and public sectors, to increase by 190,000, a decline from the previous month.

S&P and Nasdaq hit new highs again, with Tesla surging 6.54%, Nvidia up 4.57%, and Google, Apple, and Microsoft all reaching new highs, while European stocks generally rose.

On Wednesday, July 3rd, although the tech-heavy Nasdaq opened lower, it accelerated upwards an hour after the opening and closed at the daily high; the S&P 500, which also opened lower, fluctuated upwards throughout the day, setting a new daily high at the close; the Dow Jones, which is composed of blue-chip stocks, opened up by 27 points, but the intraday decline expanded and set a new low for the day, recovering slightly at the end, closing only slightly down. The Russell Small Cap Index rose 0.76% and then gave up most of its gains, closing only slightly up, with the Nasdaq having the largest relative increase among the major indices.

As of the close, the S&P 500, Nasdaq, and Nasdaq 100 all set new closing highs, with the S&P 500 and Nasdaq marking their 33rd and 22nd record highs for the year, respectively, while the Dow Jones fell slightly by 0.06%, and the Russell Small Cap Index moved away from its low point of over three weeks.The S&P 500 index closed up by 28 points, a gain of 0.51%, at 5537.02 points, marking two consecutive days of record closing highs. The Dow Jones Industrial Average fell by 23.85 points, a decrease of 0.06%, to close at 39308.00 points. The Nasdaq Composite rose by 159.54 points, an increase of 0.88%, to 18188.30 points, setting a record for three consecutive days of historical closing highs.

The Nasdaq 100 gained 0.87%, also reaching a record closing high for two days in a row; the Nasdaq Technology Market Capitalization-Weighted Index (NDXTMC), which measures the performance of technology stocks in the Nasdaq 100, rose by approximately 1.34% to a new closing high; the Russell 2000 small-cap index increased by 0.14%; the "fear index" VIX rose by 0.5% to 12.09.

The Nasdaq and S&P 500 performed exceptionally well, while the Dow and small-cap index closed essentially flat.

Among the 11 sectors of the S&P 500 index, the Information Technology/Tech sector closed up by 1.48%, surpassing the record high set on June 20th; the Materials sector rose by over 0.8%, the Energy sector by over 0.4%, the Consumer Discretionary sector by over 0.3%, the Telecommunications sector by 0.2%, while the Healthcare sector closed down by over 0.7%.

Twelve stocks in the S&P 500 index hit 52-week highs, and 8 set all-time highs, such as Intercontinental Exchange, JPMorgan Chase, Eli Lilly, Apple, Fair Isaac, Microsoft, Iron Mountain, etc., all reaching new historical highs.

Goldman Sachs released a report on Wednesday stating that the recent annual adjustments have increased the weight of healthcare and financial sectors in small-cap stocks, while the technology sector's weight has correspondingly decreased. The Russell 2000 index is now more reliant on the financial sector, particularly regional banks, and the performance of these sectors has put pressure on the small-cap index while large-cap stock indices continue to hit new highs.

Ryan Detrick, Chief Market Strategist at Carson Group, noted that July 3rd has historically been the best-performing day in the summer, with the S&P 500 index averaging a daily gain of 0.31% on July 3rd since 1950.

Jim Paulsen, author of the Paulsen Perspectives newsletter, stated that this is the only bull market in post-war history that exists under the Federal Reserve's continuous tightening policy. Despite indices like the S&P 500 reaching new highs, this bull market is actually "narrow," as only a few stocks benefit from the Federal Reserve's rate hikes, which is not common in historical bull markets. If the Federal Reserve decides to cut rates, then I believe the stock market will receive more stimulus factors, and we may welcome a new bull market. After a strong performance in the first half of 2024, the stock market is expected to continue its upward momentum.

However, Richard Bernstein, a Wall Street veteran, believes that although the current U.S. stock market seems to be full of bubbles with a highly concentrated rise in large-cap stocks, considering the current acceleration in corporate earnings and the healthy performance of the banking system, it is unlikely to trigger another economic crisis. A financial storm may be brewing, and the Federal Reserve seems to have not yet learned lessons from history.

Most star tech stocks closed higher. Tesla led the U.S. "Seven Sisters" in gains, rising by 6.54% to $246.39, marking seven consecutive trading days of increases, the longest streak in a year, with a cumulative increase of nearly 34.95% since the close on June 24th. In addition, Apple rose by 0.58%, Microsoft by 0.32%, Google A by 0.31%, "Metaverse" Meta by 0.09%, while Amazon fell by 1.21%.Chip stocks rebounded collectively. The Philadelphia Semiconductor Index closed up 1.92%, and the industry ETF SOXX also closed up 1.67%. Nvidia closed up 4.57%, and the Nvidia double leveraged ETF closed up 8.99%.

In addition, TSMC ADR rose 3.86% to a historical high, ARM closed up 2.92%, Applied Materials closed up 1.02%, KLA closed up 1.69%, Broadcom closed up 4.33%, Micron Technology closed up 3.19%, Intel closed up 0.51%, Qualcomm closed up 1.82%, while AMD closed down 0.25%.

Most AI concept stocks rose. BigBear.ai closed up 2.07%, C3.ai rose 1.67%, Advanced Micro Devices rose 1.17%, Oracle rose 0.77%, Snowflake rose 0.66%, CrowdStrike rose 0.55%, Palantir rose 0.08%, while SoundHound.ai fell 0.25%, Dell fell 0.56%.

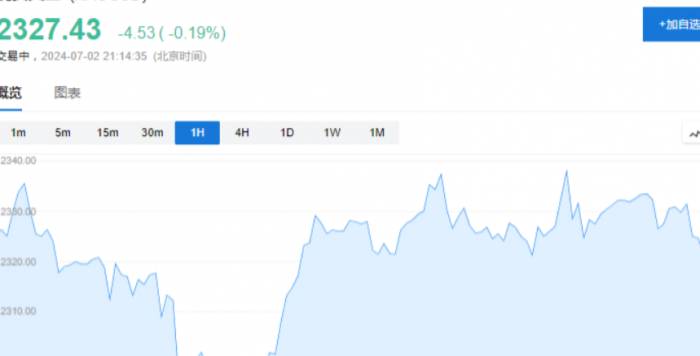

Chinese concept stocks strongly outperformed the broader US stock market. The Chinese Internet Index ETF (KWEB) rose over 3%, the China Technology Index ETF (CQQQ) rose nearly 3%, the NASDAQ Golden Dragon China Index (HXC) rose 3.3%, breaking through 6000 points to a two-week high.

Among popular stocks, the new force in car manufacturing surged, with Zeekr rising 9.28%, XPeng Motors rising 9.04%, NIO rising 7.51%, and Li Auto rising 6.53%. Douyu led with a rise of over 42%, Huya and Zhihu rose over 10%, Baidu rose 3.67%, JD.com rose 2.99%, Tencent Holdings (ADR) rose 2.89%, Pinduoduo rose 2.58%, Alibaba rose 2.57%, and NetEase rose 2.09%. Douyu's board of directors announced a special dividend distribution, approximately $9.76 per share.

In terms of news:

Novo Nordisk: Novo Nordisk was impacted by reports that its weight loss drug may cause serious eye diseases, with the stock falling more than 4.8% at its lowest during the trading day. On the other hand, as the United States announced its goal to reduce the price of weight loss drugs, Novo Nordisk ADR and other biotech company stocks fell, leading to poor performance in the healthcare industry.

Tesla: On Wednesday night, Tesla's official Weibo account announced that the second-generation humanoid robot Optimus will make its debut at the 2024 World Artificial Intelligence Conference held in Shanghai from July 4th to 7th, to "witness the evolution of humanoid robots". Wedbush raised its target price from $275 to $300, and Bank of America raised its target price to $260.

Amazon: Reports indicate that Amazon has decided not to continue with its Astro for Business security robot and will shift its focus to consumer robot products.

Nvidia: According to data disclosed in regulatory filings, Huang Renxun sold 1.3 million shares of Nvidia in June, with media estimates valuing these shares at nearly $169 million, setting a new record for his personal monthly stock sales.Li Auto: Reports indicate that Li Auto has launched a limited-time 0-down-payment car purchase scheme to boost sales. Additionally, data from the China Passenger Car Association shows that from June 1st to 30th, the retail sales of new energy passenger cars reached 864,000 units, a year-on-year increase of 30% and a month-on-month increase of 6%.

Retail investor enthusiasm for meme stocks remains unabated. Gauss Electronics surged by 143.81%, GameStop closed up by 1.63%, BlackBerry closed up by 1.63%, while AMC Entertainment Holdings fell by 3.45%.

Investors are gearing up for two national parliamentary elections, with the UK election set for Thursday and the second round of the French parliamentary elections on Sunday. On Wednesday, European stocks rose across the board:

The pan-European Stoxx 600 index closed up by 0.74%, and the Eurozone STOXX 50 index closed up by 1.21%.

The German DAX 30 index closed up by 1.16%, the French CAC 40 index closed up by 1.24%, the Italian FTSE MIB index closed up by 1.09%, the UK FTSE 100 index closed up by 0.61%, and the Spanish IBEX 35 index closed up by 1.32%.

Economic weakness has pushed down U.S. Treasury yields, with the 5-year to 10-year Treasury yields falling by more than 10 basis points during the session.

ISM data for the service sector has boosted expectations for a Federal Reserve rate cut, and by the end of the day, the two-year Treasury yield, which is sensitive to interest rates, fell by 2.9 basis points to 4.7059%; the U.S. 10-year benchmark bond yield fell by 7.29 basis points to 4.3587%.

The two-year Treasury yield, which is more sensitive to monetary policy, fell the most by 7 basis points to 4.67%, then rebounded above the 4.70% mark, reaching a near three-week low. The 10-year benchmark bond yield fell the most by 10 basis points to 4.33%, further distancing itself from the one-month high since May 31st. The 5-year and 7-year Treasury yields both fell by 10 basis points at one point, and the 30-year long-term bond yield fell by more than 9 basis points at its deepest.

At the beginning of this week, medium to long-term U.S. Treasury yields had jumped by double digits due to the increased likelihood of Trump winning the U.S. presidential election.

The benchmark 10-year German bund yield fell by 1.7 basis points at the end of the day, to 2.585%, trading in the range of 2.642%-2.567% during the session. The two-year German bund yield rose by 1.3 basis points, to 2.918%, trading in the range of 2.894%-2.952% during the session.French 10-year government bond yields fell by 6.7 basis points, Italian 10-year government bond yields fell by 7.3 basis points, Spanish 10-year government bond yields fell by 6.5 basis points, and Greek 10-year government bond yields fell by 6.9 basis points. UK 10-year government bond yields fell by 7.6 basis points, to 4.172%.

Expectations of interest rate cuts heated up, with the US dollar falling by over 0.3%, and the Japanese yen nearly hitting 162, approaching the lowest since 1986.

The US Dollar Index (DXY), which measures the US dollar against a basket of six major currencies, fell by 0.35% to 105.347 points. It experienced a significant drop during the US ISM non-manufacturing data release, reaching a daily low of 105.049 points, the lowest in three weeks. There was no significant movement after the release of the Federal Reserve's meeting minutes.

The Bloomberg Dollar Index fell by 0.25%, to 1265.88 points, with intraday trading ranging from 1270.52 to 1262.35 points.

The euro rose by 0.5% against the US dollar and once pierced through the 1.08 level, reaching a nearly three-week high. The British pound rose by nearly 100 points or 0.7% against the US dollar, breaking through 1.27, after last week it had approached 1.26, the lowest since mid-May.

The offshore renminbi against the US dollar once fell below 7.31 yuan during the Asian trading session, reaching an eight-month low, but turned positive during the US stock market trading and once pierced through 7.30 yuan.

The Japanese yen against the US dollar fell to 161.99 during the European stock trading session, the lowest since 1986, and nearly recovered to 161.64 during the US stock market trading. The yen against the euro also set a historical low of 173.80 on Wednesday.

Most mainstream cryptocurrencies fell. The largest by market value, Bitcoin, fell by 3.70%, to $59,885.00. The second-largest, Ethereum, fell by 4.35%, to $3,277.00.

A sharp decline in US crude oil and gasoline inventories indicates rising oil demand, with international oil prices closing up by nearly 1.3%.

WTI crude oil futures for August rose by $1.07, a gain of over 1.29%, to $83.88 per barrel. Brent crude oil futures for September rose by $1.10, a gain of over 1.27%, to $87.34 per barrel.When the U.S. stock market hit a new daily low in the early session, U.S. crude oil fell by a minimum of $0.35 or 0.42% to $82.46, while Brent crude oil dropped by a maximum of $0.35 or 0.4% to $85.89. Later, as they accelerated to new daily highs, U.S. crude oil rose by a maximum of $1.12 or 1.35% to $83.93, and Brent crude oil climbed by a maximum of $1.15 or 1.33% to $87.39.

According to the U.S. Energy Information Administration (EIA), U.S. EIA crude oil inventories decreased by 12.16 million barrels last week, compared to analysts' expectations of a decrease of 4.1129 million barrels and a previous increase of 3.591 million barrels. The sharp decline in U.S. EIA crude oil inventories by over 12 million barrels last week brought the inventory to its lowest level since July 2023, with gasoline inventories also falling by 2.2 million barrels. Moreover, aviation fuel exports reached a seasonal historical high, and oil exports rebounded to 4.4 million barrels per day.

The latest data from the American Automobile Association (AAA) shows that as the Independence Day holiday approaches, gasoline prices have slightly increased, currently averaging $3.51 per gallon, up 2 cents from the previous week. At the same time, AAA predicts that a record-breaking 60 million Americans will choose to travel by car during this long weekend to enjoy the holiday.

Analysis points out that the significant drop in U.S. inventories implies an increase in oil demand. Kpler's Chief Oil Analyst, Matt Smith, noted: "Despite increased refining activity, the unexpected decline in gasoline and distillate inventories reflects an actual increase in demand for both. Particularly for gasoline, as the Independence Day holiday approaches, gas stations have increased their reserves, leading to a surge in gasoline demand."

Furthermore, the impact of hurricanes on oil prices is less than the decline in oil inventories. After the latest forecast showed that the hurricane is unlikely to have a significant impact on offshore oil production, traders' concerns about supply issues have eased. Helima Croft, Head of Global Commodity Strategy at RBC Capital Markets, observed that as the U.S. dependence on offshore oil production decreases, the impact of hurricanes on the oil market has become less noticeable.

U.S. natural gas futures for August closed down by about 0.70%, at $2.4180 per million British thermal units. U.S. August gasoline futures closed at $2.6013 per gallon, and U.S. August heating oil futures closed at $2.6343 per gallon.

The latest data released by the U.S. Energy Information Administration shows that U.S. natural gas inventories increased by 32 billion cubic feet, exceeding market expectations of 29 billion cubic feet. Although the current natural gas inventory is 18.8% higher than the seasonal average, natural gas prices remain near the low point of the past seven weeks due to increased production and market oversupply.

Thanks to the rising expectations of a Federal Reserve rate cut in September, gold prices climbed over 1%, approaching a two-week high, with copper in London closing up over 2% for four consecutive days.

COMEX August gold futures rose by about 1.42% to $2,366.6 per ounce, and COMEX July silver futures rose by about 3.88% to $30.81 per ounce.

Spot gold continued to rise, with the U.S. stock market hitting a new daily high in the early session, once rising by more than 1.5% or $35, breaking through the $2,360 mark. Spot silver rose by nearly 3.9%, breaking through the $30.5 mark.New York-based independent metal trader Tai Wong analyzed, "Under the impetus of ADP employment and unemployment benefit application data, the precious and base metals markets rose across the board. These data further confirm the trend of economic slowdown, which is likely to lead to the first interest rate cut in September. Many investors are trying to get ahead of the anticipated weak employment report expected to be released on Friday."

In other precious metals, the price of platinum rose by 1.8%, and the price of palladium increased by 2.7%.

The weakening of the US dollar has strengthened the base metals in the London industrial metals market:

The economic indicator "Dr. Copper" closed up by $196, a gain of over 2.02%, at $9,868 per ton. Aluminum on the London Metal Exchange (LME) closed up by $26, a 1.03% increase. Zinc on the LME closed up by $68, approximately a 2.33% increase. Lead on the LME closed up by $20, at $2,222 per ton. Nickel on the LME closed up by $319, a rise of over 1.87%. Tin on the LME closed up by $441, approximately a 1.34% increase.

Join the Discussion