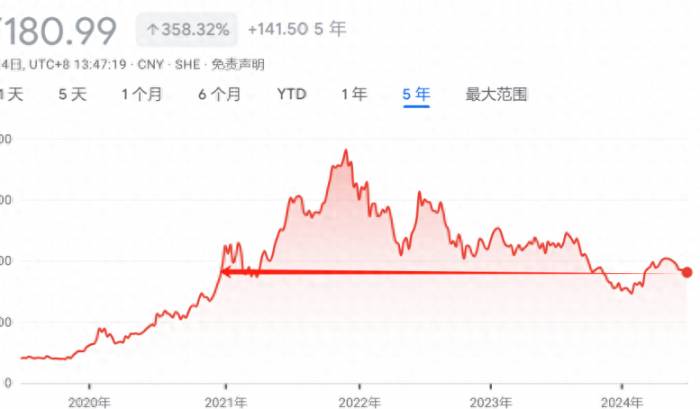

The 2023 "report cards" of listed insurance companies have all been revealed. Looking at the performance of the five major listed insurance companies on the A-share market, there is a significant improvement on the liability side of life insurance, but the decline in net profit due to the impact on the asset side is a common point of last year's full-year performance.

First Financial Daily reporters found through statistics that the total net profit attributable to the parent company of the five major listed insurance companies on the A-share market in 2023 was 165.5 billion yuan, with each showing a double-digit year-on-year decline. If all are adjusted to the new accounting standards, their total net profit attributable to the parent company would be about 190.6 billion yuan, but there is also a double-digit decline. The "culprit" of the net profit decline is the poor performance on the asset side.

Compared with the asset side, the new business value of life insurance on the liability side of listed insurance companies last year showed a double-digit increase, and the results of life insurance reform are reflected in the annual reports of each company.

Poor net profit performance

The net profit attributable to the parent company of listed insurance companies on the A-share market in 2023 was generally poor.

Data from First Financial Daily reporters show that the total net profit attributable to the parent company of the five major listed insurance companies (Ping An, China Life, China Pacific, People's Insurance, and New China Life) in 2023 was 165.5 billion yuan. Compared with the 2023 data and 2022 data listed in the financial statements, the net profit attributable to the parent company of 165.5 billion yuan decreased by 23.25% year-on-year. Among the five listed insurance companies on the A-share market, only China Life has adopted a transitional plan and has not yet implemented the new insurance contract and new financial instrument accounting standards. If adjusted to the new accounting standards, the total net profit attributable to the parent company of the five insurance companies would be about 190.6 billion yuan.

The overall decline of 23.25% was broken down to each insurance company, all showing double-digit declines. Among them, People's Insurance and New China Life had relatively smaller declines, at 10.2% and 11.3% respectively; China Life's year-on-year decline under the old standards was 34.2%. However, it is worth noting that due to the implementation of new accounting standards and different disclosure of comparable data, the comparability of net profit attributable to the parent company also varies.

For example, Ping An has been implementing new financial instrument standards for several years, so there is no comparability issue. China Pacific and New China Life switched to new insurance contract standards and new financial instrument standards at the same time in 2023. The comparative figures for 2022 were adjusted retrospectively according to the requirements of the new insurance contract standards, but they chose not to adjust the investment business related to the same period of the previous year under the new financial instrument standards, so the net profit is not fully comparable. Among them, New China Life disclosed that under the simulation adjustment to make the 2022 data basically comparable, the net profit attributable to the parent company's shareholders in 2023 decreased by 43%.

Although the year-on-year decline is not the most accurate, the overall direction of the decline in net profit attributable to the parent company is certain, and the most important reason for the poor net profit performance of listed insurance companies on the A-share market is the setback on the asset side.

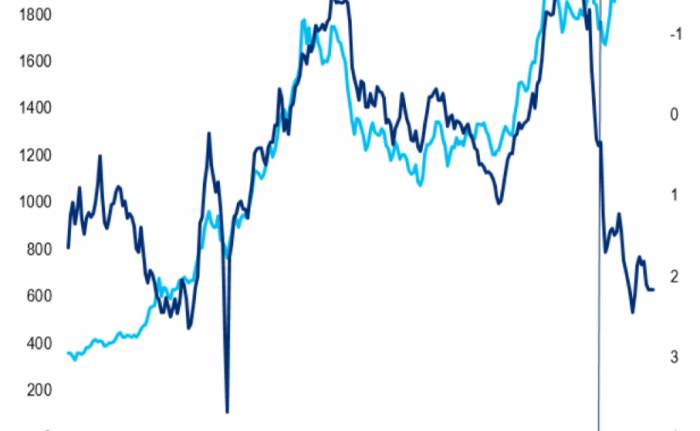

For example, China Life stated that the company actively balances long-term value and short-term benefits, continues to strengthen cost control and underwriting management, but due to the impact of the equity market's continuous low operation, the investment income decreased year-on-year, and the company's net profit has decreased; China Pacific also attributed the main reason for the decline in net profit in the annual report to the decrease in investment income.Looking at the total investment income of the five A-share listed insurance companies, apart from Ping An Insurance achieving a 33% increase, the other four A-share listed insurance companies all showed declines ranging from 20% to 50%. Among them, New China Life Insurance saw a year-on-year decrease of 50.3%, performing the worst among the five A-share listed insurance companies, directly dragging its total investment return rate into the "1" range (1.8%), a decrease of 2.5 percentage points year-on-year. In contrast, Ping An Insurance and People's Insurance of China maintained their total investment return rates in the "3" range, with People's Insurance of China's 3.3% being the best performance.

New China Life Insurance's Vice President, Gong Xingfeng, candidly stated at the performance briefing that the fluctuations in the capital market in 2023 provided a vivid lesson on the risk of interest rate differential losses for the life insurance industry. The lesson lies in the leverage effect of interest rates; if they fail to cover the cost of liabilities, the losses could be substantial. The management of New China Life Insurance indicated that in 2024, they will focus on improving the company's performance and increasing investment income.

In a low-interest-rate environment, the net investment return rate, which is considered the "safety cushion" for insurance capital investment (mainly including bond interest income, stock dividend income, etc.), has also been significantly affected. Annual report data shows that the net investment return rates of the five A-share listed insurance companies in 2023 all showed a certain degree of decline. New China Life Insurance's rate decreased by 1.2 percentage points to 3.4%, with the largest decline; Ping An Insurance, China Pacific Insurance, and People's Insurance of China, despite facing some decline, are still at levels above 4%, with People's Insurance of China's 4.5% net investment return rate once again leading among the five major A-share listed insurance companies.

Although the investment business was hit in 2023, the listed insurance companies are unanimously optimistic about the improvement of the investment environment this year.

Ping An Insurance's Chief Investment Officer, Deng Bin, said in an exclusive interview with First Financial Daily: "We believe that China's economy is experiencing a bottoming out and rebound, and the stock market has already started to reflect this. After the equity market downturn in 2022 and 2023, I believe we will welcome an upward 2024."

Vice President of China Life, Liu Hui, also stated at the performance briefing that since the beginning of this year, with the continuous implementation of stable growth policies, the economic recovery and upward trend have been further consolidated and strengthened. Against the backdrop of clear economic development goals and the solid advancement of high-quality development, it is expected that this year's investment environment will significantly improve compared to last year. The stock market has seen a rebound since the Spring Festival, with market confidence somewhat restored. The overall valuation of the A-share market is still at a historical bottom, and it is expected that the stock market performance this year will be significantly better than the past two years.

"Overall, it is believed that the investment operation environment for insurance funds in 2024 will gradually improve, with significantly increased investment opportunities and a rebound in the investment return rate under the new accounting principle," said Huang Bennyao, the designated president of PICC Asset Management.

Yang Yucheng, Chairman of New China Life Insurance, also expressed a firm optimism about A-shares and H-shares and will actively participate in investments.

Double-digit growth in new business value upwards

Compared to the asset side, the recovery of life insurance on the liability side, which has gone through a period of transformational pain, is evident. After Taiping Life Insurance's new business value turned positive in the second half of 2022, leading among listed insurance companies, all have achieved a significant positive growth in new business value in 2023.Specifically, calculated on a comparable basis, the new business value of PICC (including life and health insurance) and New China Life Insurance, with relatively low bases, climbed by 105.4% and 65.1% year-on-year, respectively, with many industry analysts using terms like "soaring" or "beyond expectations" to evaluate the performance. China Pacific Insurance and Ping An Insurance achieved year-on-year increases in new business value of 30.8% and 36.2%, respectively. China Life's new business value also saw a double-digit growth, rising by 14% year-on-year.

Synthesizing the views of analysts, the increase in new business value for listed insurance companies in 2023 is attributed to both the growth in new policy premiums and the improvement in business structure.

In terms of new policy premiums, all five listed insurance companies showed positive growth to varying degrees. Ping An Insurance's new policy premiums for individual business surged by nearly 52% year-on-year, China Life's new policy premiums increased by 14.1% year-on-year, and PICC Life Insurance's first-year premiums for long-term insurance also achieved a growth of 11%. At the same time, despite the impact of the "unification of reporting and execution" in the bank insurance channel in the fourth quarter, the enthusiasm brought about by the switch in preset interest rates in the middle of the year still made a significant contribution to the growth of new business value for the full year, with some listed insurance companies' bank insurance channel seeing a triple-digit growth rate in new business value in 2023.

Additionally, the business structure of each listed insurance company has been optimized. For instance, Everbright Securities analyzed that China Life's first-year premium payments for the term insurance in 2023 amounted to 112.57 billion yuan, a year-on-year increase of 16.7%, with the growth rate expanding by 0.8 percentage points compared to the first three quarters. The first-year premium payments for policies of ten years or more increased by 18.4% year-on-year to 49.52 billion yuan, accounting for 44.0% of the first-year premium payments, an increase of 0.6 percentage points year-on-year, and a 1.9 percentage point increase compared to the first three quarters, indicating a further optimization of the business term structure. In its analysis of New China Life Insurance's annual report, Haitong Securities stated that its long-term insurance premium payments through the bank insurance channel grew significantly by 60.5%, representing a recovery in business quality.

Behind these increases, the effectiveness of the transformation in life insurance channels by listed insurance companies is reflected.

Looking at the number of agents, First Financial Daily reporters found that by the end of 2023, the number of sales agents for the top five listed insurance companies was approximately 1.44 million (with some companies reporting the number of individual insurance channel agents and others reporting average monthly figures), a further decrease of 16.2% compared to the 1.72 million at the end of 2022. Although the pace of contraction in the size of the agent force has slowed, it has not yet bottomed out. However, there is a noticeable improvement in the quality and productivity of the team.

For example, China Pacific Insurance data shows that in 2023, the average monthly first-year scale premium per insurance agent was 12,837 yuan, a year-on-year increase of 51.8%; the average monthly first-year scale premium per core staff member was 43,503 yuan, a year-on-year increase of 26.6%; and the average monthly commission income per core staff member was 6,051 yuan, a year-on-year increase of 46.3%. Ping An Insurance stated that, on a comparable basis, the average income per agent in 2023 increased by 39.2%, and the average new business value per agent increased by 89.5%. New China Life Insurance also reported that its average monthly comprehensive productivity per person was 6,293.7 yuan, a year-on-year increase of 94.4%.

Join the Discussion