Currently, 25 listed securities firms have disclosed their annual reports for 2023. Among them, Haitong Securities has the largest decline in net profit attributable to the parent company, reaching 84.59%. Why has Haitong Securities' performance plummeted?

According to the annual report, in 2023, Haitong Securities' revenue and net profit attributable to the parent company decreased by 11.54% and 84.59%, respectively. Among them, the investment banking business saw the largest year-on-year revenue decline, while the wealth management business had the largest decline in gross margin. The operating revenue of the trading and institutional business was -2.924 billion yuan, and the operating cost of overseas business was as high as 6.764 billion yuan.

Among the nine companies mainly controlled and participated in by Haitong Securities, only Haitong International Holdings Limited (hereinafter referred to as "Haitong International Holdings") incurred a loss in 2023, with a loss amounting to 8.156 billion Hong Kong dollars.

According to the annual report, in 2023, Haitong Securities' revenue was 22.953 billion yuan, a year-on-year decrease of 11.54%; the net profit attributable to the parent company was 1.008 billion yuan, a year-on-year decrease of 84.59%; the net profit attributable to the parent company after deducting non-recurring gains and losses was 271 million yuan, a year-on-year decrease of 95.40%, of which the government subsidies exceeded 800 million yuan; the net cash flow from operating activities decreased by 65.38% year-on-year.

Looking at the quarterly breakdown, in the fourth quarter of last year, Haitong Securities' net profit attributable to the parent company rarely showed a quarterly loss, which was the first quarterly loss in nearly 20 years. The net cash flow from operating activities was in a net outflow state in the first three quarters, and in the fourth quarter, it was in a net inflow state.

Specifically analyzing the revenue situation, in 2023, Haitong Securities' net income from fees and commissions was 9.353 billion yuan, a year-on-year decrease of 19.27%, mainly due to the reduction in brokerage and investment banking business fee income; net interest income decreased by 34.16% year-on-year, mainly due to the increase in interest expenses on borrowings.

Looking at the industry, the investment banking business saw the largest year-on-year revenue decline among the company's main businesses. In 2023, Haitong Securities' investment banking business revenue was 3.631 billion yuan, a year-on-year decrease of 14.80%, mainly due to the year-on-year decline in IPO financing amounts in domestic and foreign markets, and the company's equity underwriting income decreased.

The wealth management business is the business with the largest decline in gross margin for Haitong Securities in 2023. According to the annual report, in 2023, the operating revenue of Haitong Securities Group's wealth management business was 8.315 billion yuan, a year-on-year decrease of 12.03%, and the gross margin decreased by 39.2 percentage points year-on-year, mainly due to the year-on-year decrease in securities brokerage business income.

The asset management business also saw a decline in both revenue and gross margin. In 2023, the operating revenue of Haitong Securities' asset management business was 2.649 billion yuan, a year-on-year decrease of 14.16%, and the gross margin also decreased by 3.29% year-on-year, mainly due to the decline in the management scale of the asset management subsidiary, the reduction in the management fee rate, and the year-on-year decrease in management fee income.

In 2023, the operating revenue of Haitong Securities' trading and institutional business was negative, at -2.924 billion yuan, continuing to decrease by 1.219 billion yuan year-on-year from the previous year's -1.705 billion yuan, with a profit loss of 5.363 billion yuan, mainly due to the impact of capital market fluctuations. In this regard, this business has seriously dragged down the profitability of Haitong Securities.Looking at the overseas business, the revenue for the fiscal year 2023 was 780 million yuan, with a year-on-year decrease of 70.24%, while the operating costs were as high as 67.64 billion yuan, resulting in a gross margin of -766.98%.

According to the annual report, the Trading and Institutional division of Haitong Securities primarily provides global institutional investors with equity sales and trading on major global financial markets, prime brokerage, securities lending, and equity research on major markets worldwide. It also provides market-making services for fixed income products, currency and commodity products, futures and options, and derivatives on major exchanges around the world.

In other words, Haitong Securities' overseas business has suffered significant losses. This can be seen from the situation of the main controlled and participated companies of Haitong Securities, where out of 9 companies, only Haitong International Holdings incurred a loss in 2023, while the remaining 8 companies were in a profitable state.

As per the annual report, Haitong International Holdings has a registered capital of 11.18 billion Hong Kong dollars, with Haitong Securities holding 100% of the equity. As of December 31, 2023, the total assets of Haitong International Holdings were 108.542 billion Hong Kong dollars, with net assets of 7.786 billion Hong Kong dollars; in 2023, the company achieved a revenue of -1.575 billion Hong Kong dollars, and a net profit of -8.156 billion Hong Kong dollars.

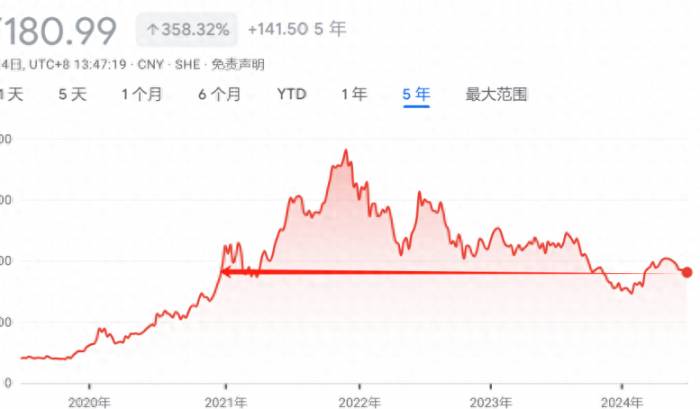

Haitong International Holdings is the largest shareholder of Haitong International (formerly stock code 00665.HK, now delisted). In 2022, Haitong International suffered a loss of 6.541 billion yuan, marking the first loss since 2009. Among this, the loss from trading and investment income was 4.721 billion Hong Kong dollars, mainly due to fluctuations in the stock and bond markets in Mainland China and Hong Kong, leading to different degrees of unrealized losses and asset impairments for the group's various investments due to market price and valuation declines.

Following this, Haitong International embarked on a path of privatization. On March 28, 2023, the board of directors of Haitong Securities reviewed and approved Haitong International Holdings' participation in the rights issue plan of Haitong International, with a rights issue ratio of 3 for every 10 shares. The number of newly issued shares in this rights issue was 1.796 billion shares, with a rights issue price of 0.65 Hong Kong dollars per share, and the total amount of funds raised was approximately 1.168 billion Hong Kong dollars. Haitong International Holdings subscribed to 1.683 billion shares in this rights issue, with a participation amount of about 1.094 billion Hong Kong dollars, increasing its shareholding ratio from 67.92% before the rights issue to 73.40%.

In August 2023, the board of directors of Haitong Securities agreed to the company's use of its own funds within China to increase its capital in Haitong International Holdings by 1 billion US dollars. In September 2023, the board of directors of Haitong Securities approved the privatization plan of Haitong International Holdings for Haitong International.

On January 11, 2024, the delisting of Haitong International from the Hong Kong Stock Exchange took effect, and it has officially been delisted.

Join the Discussion