On April 8th, the stock market indices opened low and fluctuated. By the midday closing, the Shanghai Composite Index was at 3,063.95 points, down by 0.17%, the Shenzhen Component Index was at 9,473.35 points, down by 0.75%, and the ChiNext Index was at 1,822.7 points, down by 0.96%. The gold concept, Huawei Euler, and green power sectors led the gains, while the MLCC, weight loss drugs, and perovskite battery sectors led the declines.

Let's review the market hotspots from the morning session.

**International Gold Prices Soar, Gold Concepts Show Strong Performance**

By the midday break, Xiaocheng Technology increased by over 16%, Jingu Silver Industry and Zhongrun Resources hit the daily limit, Lesheng Tongling hit the daily limit for the fifth consecutive day, and Shandong Gold, Sichuan Gold, Chifeng Gold, and others followed suit with gains.

In terms of news, international gold prices have once again reached new highs; the central bank has increased its gold reserves for the 17th consecutive month.

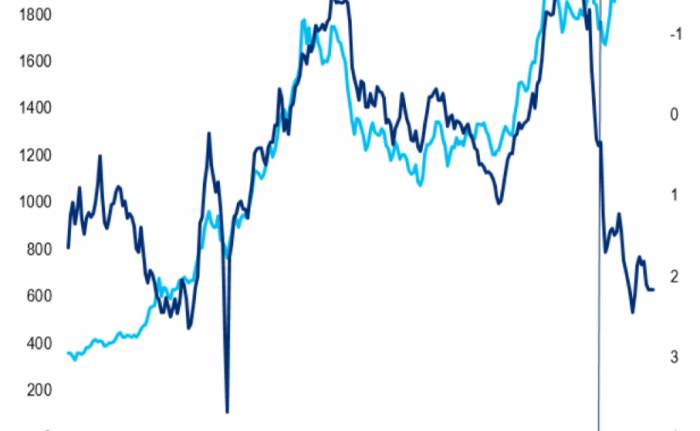

Since March, international gold prices have repeatedly set new historical records. According to Wind data, on April 5th, COMEX gold once again broke through historical highs during the session, reaching a peak of $2,350 per ounce. Data from the China Gold Association shows that in 2023, China's gold consumption volume reached 1,089.69 tons, a year-on-year increase of 8.78%.

Guotai Junan Securities stated that there is a risk of a short-term correction, but the overall trend for the year remains bullish. Based on historical experience, after gold breaks a new high, it often undergoes a round of adjustment in the short term, and the current position situation reflects that the long positions are already quite crowded.

**Copper Prices Hit New High in Over a Year, Sector Leads in Gains**

By the midday break, shares of Zinc Industry, Silver Metals, and Northern Copper all hit the daily limit, while Yuguang Gold Lead, Yunnan Copper, Chifeng Gold, Hengbang Shares, and others rose to varying degrees.

During the Qingming Festival holiday, international non-ferrous metal futures prices continued to rise. As of the close on April 5th, LME copper, aluminum, zinc, and lead had cumulative increases of 2.96%, 3%, 4.92%, and 5.32%, respectively, with international copper prices once again reaching a new high since January of the previous year.Looking ahead, Shenwan Hongyuan stated that they are optimistic about the rise in copper prices in 2024. From 2024 to 2025, the global copper mine supply is expected to be limited, and the existing supply is likely to be disrupted and fall short of expectations. On the demand side, the demand for new energy continues to grow, and it is anticipated that the supply and demand will maintain a tight balance. With the expectation of interest rate cuts, copper prices are expected to enter a long upward cycle.

【Major Adjustments to Auto Loans, Significant Growth in Related Industry Sales Expected】

The automotive sector saw a fluctuating rise in the morning, with *ST Hanma and Yaxing Bus hitting the daily limit, while Seres, BYD, GAC Group, and others followed suit.

Recently, the People's Bank of China and the State Administration of Foreign Exchange jointly issued the "Notice on Adjusting Policies Related to Auto Loans," optimizing the maximum loan-to-value ratio for auto loans and increasing financial support for the scenario of trading in old cars for new ones.

Zhao Lian, the chief researcher at China United, said that the maximum loan-to-value ratio for personal auto loans can reach 100%, which helps to enhance residents' ability to purchase cars through auto loans. Encouraging the appropriate reduction or exemption of penalties for prepayment of loans during the trade-in process can help reduce the burden on residents buying new cars through the "trade-in" method and boost their willingness to consume automobiles.

Huaxi Securities pointed out that the car market is entering a peak replacement period, with an estimated increase of 1.22 million units in replacement and purchase in 2024, benefiting mid-to-high-end models significantly. In addition, with the increase in the supply of new energy models and the decline in battery costs, the new energy sales of domestic car manufacturers are expected to see significant growth, accelerating the capture of joint venture market share.

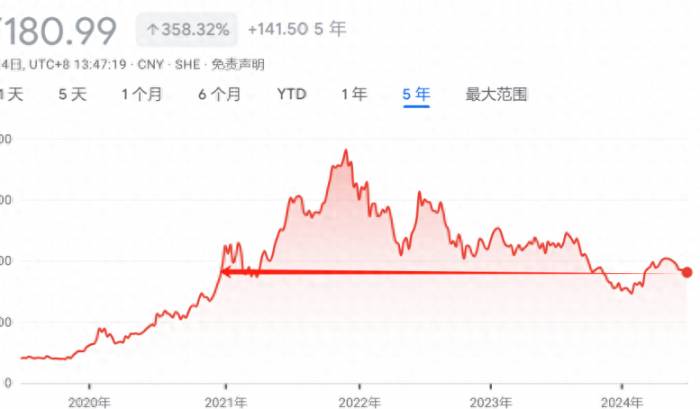

【Gold Jewelry Prices at Chow Tai Fook and Other Gold Shops Have Reached as High as 728 Yuan/Gram】

Both domestic and international gold prices have risen, with international gold prices hitting a historical high, and the prices of gold jewelry at domestic gold shops, such as Chow Tai Fook, are also maintained at a high level, with prices reaching as high as 728 yuan per gram.

【Shimao Group: China Construction Bank (Asia) Files for the Company's Liquidation】

Shimao Group announced on the Hong Kong Stock Exchange that China Construction Bank (Asia) Co., Ltd. filed a petition for the liquidation of the company with the High Court of the Hong Kong Special Administrative Region on April 5, 2024, involving an amount of approximately 1.5795 billion Hong Kong dollars of the company's financial obligations. The company believes that the petition does not represent the common interests of its overseas creditors and other relevant parties. To protect the interests of the relevant parties, the company will strongly oppose the petition and continue to promote the restructuring of overseas debts to maximize the value for the relevant parties.【RMB Central Parity Against the US Dollar Adjusted Up by 2 Basis Points】

The central parity rate of the Chinese yuan against the US dollar is reported at 7.0947, with an increase of 2 basis points. The previous trading day's central parity rate was 7.0949, with the onshore Chinese yuan closing at 7.2356 at 16:30, and the night session closing at 7.2320.

Join the Discussion