As the only A-share real estate listed company under China Communications Construction Group, China Communications Real Estate's performance last year was not impressive.

According to the announcement data of China Communications Real Estate on April 7, in 2023, the group achieved a total operating income of 32.468 billion yuan, a decrease of 15.59% compared to the previous year, and a total profit of -806 million yuan, with a net profit attributable to the shareholders of the listed company at -1.673 billion yuan. Looking at the quarters, the losses for the first to fourth quarters of last year were 201 million yuan, 366 million yuan, 463 million yuan, and 641 million yuan, respectively.

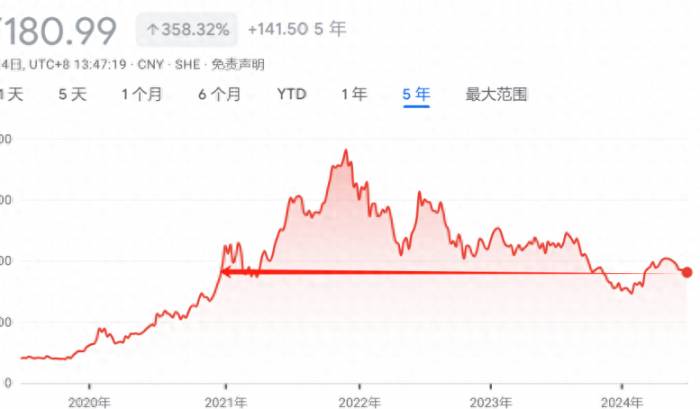

This marks the fifth consecutive year of declining profits for China Communications Real Estate. From 2019 to 2023, the group's operating income fluctuated from 14.063 billion yuan to 32.468 billion yuan; however, the net profit attributable to the mother company plummeted from 542 million yuan to a loss of 1.673 billion yuan.

China Communications Real Estate stated that there are three reasons for the net profit loss attributable to the parent company in 2023: First, the value of goods that met the delivery conditions in 2023 decreased year-on-year, leading to a reduction in real estate sales and revenue recognition; second, due to changes in the structure of the company's revenue recognition projects, the gross margin of the real estate development business for the current period's delivery projects decreased; third, some real estate development projects of the company showed signs of impairment, and the amount of provisions made during the reporting period increased year-on-year.

In the past year, China Communications Real Estate achieved a signed sales area of 1.7966 million square meters, a decrease of 8.23% compared to the same period last year, and a signed sales amount of 37.361 billion yuan, a decrease of 18.57% compared to the same period last year, with sales collections of 44.979 billion yuan, a decrease of 0.23% compared to the same period last year; the agency construction business signed a new value of 11.463 billion yuan in 2023, and achieved an agency construction collection of 52 million yuan.

The reduction in real estate sales revenue recognition, the decline in project gross margin, and the impairment provision of some assets have become the common reasons for the loss of performance of real estate companies this year. China Communications Real Estate is also not immune to losses under the general trend of the industry. Fortunately, the group has the support of a state-owned enterprise shareholder, and when real estate companies are deeply trapped in financing dilemmas, China Communications Real Estate can still issue bonds for financing.

According to the announcement, as of the end of 2023, the financing scale of China Communications Real Estate was about 61.028 billion yuan, with financing channels mainly including bank loans, bonds, trust financing, loans from controlling shareholders, and other financing channels; the financing scale at the end of the period for each channel was 27.155 billion yuan, 7.74 billion yuan, 26.423 billion yuan, 16.244 billion yuan, and 7.246 billion yuan.

Entering 2024, China Communications Real Estate continues to finance in large amounts, and there has been progress in several financing actions.

For example, on March 28, according to the disclosure of the Shenzhen Stock Exchange, the status of the 2024 private placement of corporate bonds to professional investors by China Communications Real Estate Co., Ltd. was updated to "accepted," with a proposed issuance amount of 3.8 billion yuan. On the same day, the Shanghai Stock Exchange disclosed that China Communications Real Estate Group Co., Ltd. had already privately placed corporate bonds to professional investors in 2024, with the project updated to "accepted," and a proposed issuance amount of 2.84 billion yuan.

On March 27, the Shenzhen Stock Exchange disclosed that the status of the China Gold-CC Real Estate-Asia Factoring Supply Chain Finance 16-30 Special Plan bond was feedback, with a proposed issuance amount of 2 billion yuan for this bond, and the bond category is ABS. On March 11, China Communications Real Estate disclosed that it had applied for trust financing of 300 million yuan from Xiamen International Trust Co., Ltd., with an annual interest rate cap of 7% and a maximum term of 24 months.As early as the beginning of 2023, the Shenzhen Stock Exchange had issued an inquiry letter to China Communications Real Estate, requiring it to explain whether financial indicators such as the asset-liability ratio excluding advance receipts, net debt ratio, and cash-to-short-term debt ratio were within a reasonable range; the pricing basis for loan interest rates from the controlling shareholder, whether it is reasonable, and whether there are situations that harm the interests of the listed company and small and medium investors, among other issues.

Data shows that by the end of 2023, the asset-liability ratio of China Communications Real Estate was 85.59%; the group's financing balance from various channels, with debts maturing within one year, was 10.719 billion yuan, 440 million yuan, 2.092 billion yuan, 1.113 billion yuan, and 2.671 billion yuan, totaling 17.052 billion yuan, while the monetary fund scale at the end of the period was only 12.009 billion yuan, and cash was insufficient to cover short-term debts.

Looking at the financing costs, during the period, the financing cost for bank loans was between 1.80% and 6.28%, the financing cost for trust financing was between 5.10% and 8.40%, the financing cost for loans from the controlling shareholder was between 0% and 8%, and the financing cost for other channels was between 0% and 8%. China Communications Real Estate had stated to the Shenzhen Stock Exchange that the loans from the controlling shareholder were all credit loans, without the need to specify the specific use, and under the premise of the necessity of financing, the loans from the controlling shareholder were more convenient and timely, hence the interest rate was relatively higher than bank loans.

Currently, compared with other central state-owned enterprises in the same industry, the profitability and debt situation of China Communications Real Estate are not optimistic, which is related to its more aggressive development strategy in the past few years. Data shows that from 2020 to 2022, the land acquisition payments of China Communications Real Estate were 53.58 billion yuan, 38.802 billion yuan, and 23.437 billion yuan, respectively, continuously acquiring land in large amounts, with inventory amounts of 72.03 billion yuan, 108.9 billion yuan, and 106.9 billion yuan, respectively.

It was not until 2023 that China Communications Real Estate tightened its investment pace, acquiring only two plots of land in Chengdu and Hefei last year, with a total land payment of 2.77 billion yuan and a calculated building area of 215,300 square meters. As of the end of the report period, China Communications Real Estate held 117 real estate projects, with a total land area of 10.714 million square meters and a construction and pending construction area of 12.0098 million square meters.

In terms of the risks of the company's future development, China Communications Real Estate also realized that internal risks include: the overall gross profit margin of the main business has declined, the product premium ability is insufficient, the asset-liability ratio is relatively high, and the overall professional ability of commercial operations is relatively weak.

Looking at the external environment, "The supply and demand relationship in the real estate market has changed, with sufficient supply in the total market, and inventory projects need to be further revitalized. At the same time, due to the deceleration of urbanization and the reduction of new population, regional differentiation is obvious. There is a shortage of land supply in the core areas of first and second-tier cities, but the demand for home buying and the willingness to rent are still strong. The current inventory in third and fourth-tier cities is high, but the demand is limited." The group stated.

China Communications Real Estate stated that it will follow the policy orientation in the future, analyze trends, implement policies according to the city, focus on the sustainable development of the main business and the security of cash flow; further focus investment on core cities and regions, highlight the priority of benefits; continuously optimize the financing structure, adopt diversified financing methods, and control the growth rate of the scale of interest-bearing debt; improve the overall development and operation ability of the project, strengthen financial management, and enhance the ability to resist risks, etc.

Join the Discussion