**Rouyu Falls on the Path to Industrialization**

According to information from Tianyancha, on March 29th, Shenzhen Royu Technology Co., Ltd. and its subsidiaries, Shenzhen Royu Electronic Technology Co., Ltd. and Shenzhen Royu Display Technology Co., Ltd., each added a new bankruptcy review case. Royu Technology founder Liu Zihong exclusively responded to the First Financial Daily, stating that all information should be based on official announcements. However, Liu Zihong did not provide further comments on the current state of operations at Royu Technology.

Commentary: Royu previously took the lead in launching a product that relies on its proprietary folding screen technology, which also conceals a fatal weakness of Royu Technology. The process of mass production and commercialization of laboratory products is lengthy. A senior industry insider analyzed to the First Financial Daily reporter, stating that from an industry chain perspective, for any product, the layout of upstream suppliers and downstream customers should be considered from the beginning. Royu's completeness of suppliers may be lacking, but mass production of goods requires a large volume of equipment and material suppliers.

**Huawei Returns to 700 Billion Revenue**

On March 29th, Huawei released its overall performance for 2023 on its official website. The data shows that for the full year of 2023, Huawei achieved a global sales revenue of 704.2 billion yuan, a year-on-year increase of 9.64%, and a net profit of 87 billion yuan, a year-on-year increase of 145%. According to calculations based on Huawei's past annual reports, this is also the first time since 2021 that Huawei's annual revenue has returned to the 700 billion yuan range. In addition, Huawei's terminal business achieved a sales revenue of 251.5 billion yuan last year, a year-on-year increase of 17.3%, marking a return to growth after two years of decline. Huawei's rotating chairman, Hu Houkun, stated that last year's overall business performance was in line with expectations.

Commentary: Although the performance is gradually warming up, Huawei still faces challenges brought by the complex external environment. From the normalization of sanctions to normal operations, from survival to development, how Huawei builds a more resilient supply chain capability to ensure high-quality business continuity and product competitiveness is the core of its future sustainable development.

**Apple to Hold Annual Developer Conference on June 10th**

Apple Inc. announced last week that its annual developer conference, WWDC, will be held at Apple Park in Cupertino, California, from June 10th to 14th. At this year's WWDC, it is expected that Apple may reveal its artificial intelligence strategy and AI features on the consumer side. This year's Apple Developer Conference is particularly of interest to the capital market, as the market anticipates that Apple will find new growth points amidst declining iPhone sales. Earlier this year, Apple's market value was surpassed by Microsoft, and currently, NVIDIA is catching up to Apple's market value. So far this year, Apple's stock price has fallen nearly 12%.

Commentary: Whether Apple will announce the use of Google's large model Gemini and other artificial intelligence technologies as chatbots in its operating system is also of interest to the industry. Last month, Apple CEO Tim Cook stated that Apple is "heavily investing" in the field of artificial intelligence and revealed that progress related to artificial intelligence will be released later this year, with many analysts expecting Apple to announce this information at the Worldwide Developers Conference. An industry insider analyzed to the First Financial Daily reporter that even if Apple uses Google's Gemini as support for chatbots on mobile devices, it does not hinder the development of its own AI engine. Apple's AI engine may be used in new software to handle more background tasks that users are not aware of.

**Signal from the Financial Reports of the Three Major Operators: Cloud Computing Power Becomes a New Direction for Investment**

The financial reports of the three major operators have released a signal that cloud computing power is becoming a new direction for investment.As of March 26, the 2023 annual reports of China Mobile (600941.SH), China Unicom (600050.SH), and China Telecom (601728.SH) have all been disclosed. With the peak of 5G network infrastructure investment behind them, cloud computing power is emerging as a new focus for operators' investments.

At the performance communication meeting held on March 26, Ke Ruiwen, Chairman of China Telecom, mentioned that China Telecom has a significant advantage in developing artificial intelligence, which is computing power and intelligent computing power. The second major advantage is the vast amount of data; China Telecom's database currently holds 500 petabytes (PB) of data, with several additional petabytes being added daily.

Commentary: At the 2023 performance briefing not long ago, China Mobile announced an adjusted plan where the capital expenditure for 5G networks in 2024 will be reduced from 88 billion yuan in 2023 to 69 billion yuan, a decrease of approximately 20%. However, despite the overall investment amount declining, the budget for computing power, capabilities, and infrastructure is not only maintained but increased. First Financial Daily reporters noted that in terms of net new 5G package customers, China Mobile added 180 million new customers in 2023, a year-on-year decrease of 20.6%. China Unicom's financial report also showed that the growth rate of 5G package users in 2023 decreased by 5.1 percentage points year-on-year. The industry believes that under the impetus of digital transformation, the three major operators have transitioned from being under pressure to breaking through, achieving high growth in both revenue and profits. With the gradual advancement of the 5G-A commercialization plan, computing power has become the key to the operators' successful transformation and upgrading.

China Mobile Announces Official Commercialization of 5G-A

On March 28, China Mobile announced the official commercialization of 5G-Advanced. Gao Tongqing, Deputy General Manager of China Mobile, stated, "Today, China Mobile, in conjunction with global industry partners, officially released the commercialization plan for 5G-A, further accelerating the construction of new-type information infrastructure and the new information system, unleashing the unlimited possibilities of 5G."

At the press conference, Gao Tongqing proposed an initiative suggesting that the industry should jointly focus on technological innovation for 5G-A to seize the technological high ground. Additionally, he pointed out that in terms of network construction, China Mobile plans to collaborate with supply chain manufacturers in 2024, following the principle of "moderate advancement," to promote the application of 5G-A in over 300 cities in China and initiate the deployment of the world's largest international commercial network. Regarding the popularization of terminals, in 2024, China Mobile will work with terminal manufacturers and chip suppliers to comprehensively promote the industrial upgrade of terminals.

In the GSMA's "China Mobile Economy 2024" report released on the 26th, it was disclosed that China's 5G mobile connections have exceeded 800 million. In 2024, the proportion of 5G connections is expected to rise from 45% to over 50%, becoming the dominant mobile technology in China, with the total number of 5G connections expected to climb further to over 1 billion by the end of the year.

Commentary: 5G-A, full name 5G-Advanced, also known as 5.5G, is a key phase in the evolution from 5G to 6G. With the upcoming completion of the 3GPP Release 18 standard specifications, the implementation of 5G-A solutions is imminent, and it will serve as a bridge to 6G. Data provided by the GSMA's think tank team to First Financial Daily shows that more than half of the operators expect to deploy 5G-A within one year after the standard is released and to initiate a new round of investment in 2024.

Upgrade of Domestic AI Framework

Huawei announced that the Ascend MindSpore AI framework has achieved a breakthrough upgrade, becoming the industry's first framework to natively support large models. To date, the Ascend AI framework has open-sourced more than 500 model projects, involving over 5,500 enterprises. Companies such as iSoftStone, iFLYTEK, and SenseTime have all achieved compatibility with Ascend. The Ascend MindSpore AI framework was open-sourced by Huawei in March 2020. Since 2023, the number of top conference papers published based on this framework has exceeded 1,200, ranking first in China and second globally among all AI frameworks.Commentary: As a major platform for independent innovation, the AI framework serves as a bridge between algorithmic applications and hardware computing power. In the artificial intelligence race represented by large models, this software root technology is one of the key elements supporting the innovation of large models. The development of domestic AI frameworks has, to a certain extent, changed the previous duopoly dominated by Google and Meta's AI frameworks, and has also broken NVIDIA's CUDA "monopoly" in computing architecture, laying the foundation for domestic enterprises to take the initiative in the core software field.

Android smartwatches debut with "independent WeChat"

On March 29, the OPPO Watch X was released, marking the first smartwatch in the Android camp to deeply cooperate with WeChat and support independent login, breaking free from the previous distance limitations of Bluetooth connections. The "China Wearable Device Market Quarterly Tracking Report" published by IDC points out that the domestic smart wearable device sales volume in 2023 was 37.4 million units, a year-on-year increase of 7.5%, and is in a steady recovery state.

Commentary: Since the advent of smart wearable devices in 2012, they have gradually become one of the most important parts of the consumer electronics market. In addition to brands like Fitbit that focus on smart bracelets and watches, there are also mobile phone manufacturers and PC manufacturers joining the competition, making the situation quite fierce. However, many enterprises have launched smartwatches with imperfect app ecosystems, which are more like large bracelets rather than smartwatches. The improvement of the ecosystem and the enhancement of battery life have continuously increased the practicality of smartwatches, which may be a key factor in the year-on-year growth of smart wearable device sales.

BOE's 8.6th generation OLED production line foundation laying

On March 27, BOE Technology Group Co., Ltd. (BOE) laid the foundation for the first 8.6th generation OLED production line in China in Chengdu, with a total investment of 63 billion yuan. The designed production capacity is 32,000 glass substrates per month, mainly producing high-end touch OLED display screens for smart terminals such as laptops and tablet computers. This production line will greatly improve the cutting efficiency of medium-sized OLED panels and reduce production costs.

Commentary: The overall shipment of small-sized flexible OLED panels in mainland China has approached half of the global total, gradually competing with South Korean enterprises. However, there is still a blank in the field of medium and large-sized OLED panels. As the application of OLED panels extends from smartphones to medium-sized areas such as laptops and automotive displays, Chinese display panel leaders, including BOE, have begun to enter the industrialization field of medium and large-sized OLED panels.

LG Energy Solution increases battery capacity in China

On March 27, news came out that Jiangning Binjiang Development Zone in Nanjing, Jiangsu, and South Korea's LG Energy Solution Group signed an investment intention agreement. According to the relevant agreement, LG Energy Solution plans to invest about $800 million (approximately 5.774 billion yuan) to build the LG lithium battery project, mainly involving the production of power batteries and energy storage batteries.

Commentary: The business structure of LG's companies in China is changing. LG Energy Solution is currently ranked third in the world, with production capacity second only to CATL and BYD. With the rapid development of China's electric vehicle industry, LG Energy Solution also hopes to catch this "fast train". There are reports that LG Energy Solution is also brewing to set up a regional headquarters in China. At the same time, LG Display's 8.5th generation LCD panel production factory in Guangzhou is rumored to be transferred to Chinese enterprises to focus on the development of OLED business.China Resources Group Becomes the Actual Controller of Changdian Technology, Industry Insiders Say It Will Accelerate Industry Integration

On the evening of March 26, Changdian Technology (600584.SH) released the latest announcement stating that the company's shareholders, the Big Fund and Xindian Semiconductor, respectively signed a "Share Transfer Agreement" with Panshi Hong Kong Limited (referred to as "Panshi Hong Kong"). Both the Big Fund and Xindian Semiconductor transferred a combined 22.53% of the company's shares to Panshi Hong Kong or its affiliates at a price of 29 yuan per share. After the completion, the controlling shareholder of the company will change to Panshi Hong Kong or its affiliates. Public information shows that the controlling shareholder of Panshi Hong Kong is China Resources Group, and the actual controller is China Resources. After the completion of this equity transfer, Changdian Technology will change from having no actual controller to being controlled by China Resources, and the company's stock will resume trading on March 27.

Commentary: Regarding China Resources Group becoming the actual controller of Changdian Technology, industry insiders analyzed to the First Financial Journalist that the semiconductor industry is an industry with fine division of labor, close cooperation, long industry chain, and numerous links. The semiconductor industry in China and the world is continuously developing, with a promising market growth prospect, which requires more high-quality companies to cooperate and achieve a win-win situation. China Resources Group has a comprehensive consideration and full judgment of the market, and its layout in different segments of the semiconductor industry helps to enhance its industrial status in the industry and accelerate industry integration.

Micron's Xi'an Packaging and Testing Factory Expansion Project Begins Construction

On March 27, First Financial journalists learned that Sanjay Mehrotra, President and CEO of the American semiconductor company Micron (Micron) Technology, appeared in Xi'an, China, to lay the foundation for the company's new factory in Xi'an. It is reported that the factory will be used to produce Micron's DRAM, NAND, SSD, and other products. Reporters learned that Micron announced an additional investment of 4.3 billion yuan in Xi'an in June 2023, which includes the construction of a new factory and the introduction of a new production line. The production line of the new factory will include but is not limited to mobile DRAM, NAND, and SSD, thereby expanding the existing DRAM packaging and testing capabilities of the Xi'an factory.

Commentary: In terms of revenue share, China is Micron's largest market outside the United States. According to Micron's latest annual report for 2023 (from September 2022 to August 2023), the company's total revenue in China for the fiscal year 2023 was 3.039 billion US dollars, accounting for nearly 20% of the total revenue.

Micron's official website information shows that the company has a total of 5 companies in Mainland China, with 2 in Shanghai, and 1 in Beijing, Shenzhen, and Xi'an respectively. Among them, the Xi'an company is the most critical manufacturing center for Micron in China, and Micron's investment in the Xi'an factory is obviously significant in terms of expanding production capacity and occupying the market.

Kuaishou Discloses Progress in Large Model Development

On March 26, at the Kuaishou Magnetic Power Conference, it was disclosed that in 2023, the annual GMV of Kuaishou e-commerce exceeded 1.18 trillion, the local life GMV in the fourth quarter of 2023 grew 25 times year-on-year, and the cumulative housing transaction amount of the Ideal Home real estate business in the fourth quarter of 2023 exceeded 16 billion yuan.

In addition, in the field of AI, Kuaishou has developed a large language model in the marketing domain by conducting trillion-level Token commercial knowledge pre-training and million-level commercial instruction alignment for the Kuaiyi general large model. In terms of intelligent production, Kuaishou has developed a video AIGC product "Pangu" and a digital human live broadcast AIGC product "Nüwa".Commentary: Orient Securities' research report analysis suggests that in terms of user growth, Kuaishou has optimized the efficiency of growth across various channels, with the customer acquisition cost per new user continuing to decline year-on-year. With the proportion of high-margin advertising and e-commerce businesses in the revenue structure increasing, the gross margin is expected to continue to improve.

In March, 107 domestic games were granted publishing numbers

On March 29, the National Press and Publication Administration announced the approval information for domestic online games in March, with a total of 107 games approved. In this month's list of approved publishing numbers, mobile games became the absolute mainstay, with a significant number of products clearly labeled as "casual puzzle" reaching 57.

The manufacturers approved for publishing numbers this month are mainly small and medium-sized, with Tencent and NetEase not having any publishing numbers approved. Notable products include Xi Shan Ju's "Unlimited Machine," Kuaishou's subsidiary Xing Zhen Technology's "Mysterious Master," Giant Network's "Masterless Throne," and Youxing's "Star Tower Traveler," among others.

Commentary: As of March, a total of 333 domestic game publishing numbers and 32 imported game publishing numbers have been issued this year. In January to March, 115/111/105 domestic game publishing numbers were issued respectively. Including December 2023, the number of publishing numbers issued has broken the hundred mark for four consecutive months, maintaining a stable and orderly trend.

Financial reports released, SMIC and Hua Hong Semiconductor's 2023 revenue and net profit both shrink

On the evening of March 28, two wafer foundry companies, SMIC (688981.SH) and Hua Hong Semiconductor (688347.SH), released their financial reports. The data shows that the key revenue indicators for both foundries shrank year-on-year in 2023. According to the performance explanation, the semiconductor industry is at the bottom of the cycle, and weak global market demand is the main reason for the performance shrinkage of both companies.

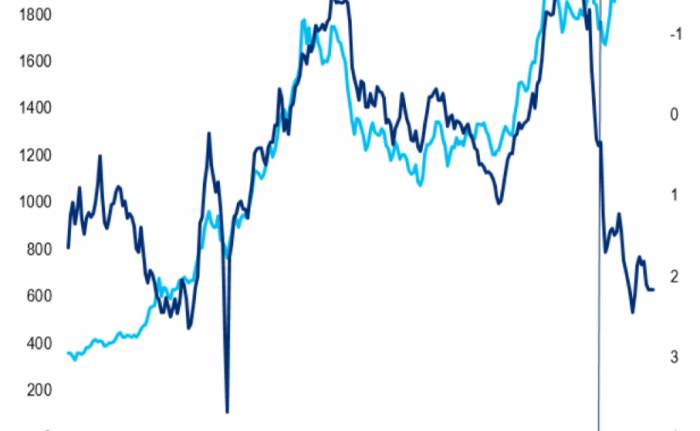

In terms of revenue and profit, in 2023, SMIC achieved a total revenue of 45.25 billion yuan, a year-on-year decrease of 8.6%; during the same period, the net profit attributable to shareholders of the listed company was 4.823 billion yuan, a year-on-year decline of 60.3%; the average annual capacity utilization rate was 75%, basically in line with the guidance at the beginning of the year.

Hua Hong Semiconductor achieved a total revenue of 16.232 billion yuan in 2023, a year-on-year decrease of 3.30%, and a net profit of 1.936 billion yuan, a year-on-year decrease of 35.64%; in terms of capacity, the company's equivalent 8-inch wafer capacity utilization rate reached 94.3%, and the average capacity was basically the same as in 2022.

Commentary: The industrial and automotive product-related business, which was once considered the "savior" of the performance of wafer foundries, did not have the ability to fill the decline in revenue in the consumer electronics field for SMIC. Under the new energy vehicle boom, automotive semiconductors once became the supporting force for the performance of various wafer foundries under the weak consumer market, including global semiconductor giants such as Intel and TSMC, which had previously adjusted their business structures to increase the foundry production of automotive-related chips. However, it seems that even the performance "savior" is difficult to resist the impact of the decline in consumer electronics on the performance of wafer foundries.Suteng Jucheng's revenue grew last year, but it has not yet turned a profit.

Suteng Jucheng released its first annual report since going public, with a total revenue of 1.12 billion yuan in 2023, a year-on-year increase of 111.2%. The adjusted net loss was approximately 434 million yuan, narrowing by 22.8% compared to the previous year. In 2023, the company sold nearly 260,000 lidar products, of which about 243,000 were ADAS lidar products, a year-on-year increase of 558.5%. Along with the increase in sales volume, the average unit price of the company's products for ADAS applications decreased from about 4,300 yuan per unit in 2022 to about 3,200 yuan per unit in 2023. At the financial report meeting, Suteng Jucheng's Chairman of the Board and CEO, Qiu Chunchao, stated: "The trend in prices this year will not change significantly."

Commentary: In February of last year, Hesai Technology went public on NASDAQ, becoming the "first Chinese lidar stock." In January of this year, Suteng Jucheng was listed on the Hong Kong Stock Exchange. After the two leading lidar companies went public, when they will turn a profit has attracted much attention. Last year, Suteng Jucheng's ADAS product revenue increased by 384.6% year-on-year, and the gross margin of lidar products for ADAS applications narrowed from -101.1% the previous year to -5.9% in 2023. However, in the wave of supply chain cost reduction driven by car manufacturers' price cuts, lidar manufacturers still face certain pressures, and Suteng Jucheng has not yet turned a profit. Hesai Technology, on the other hand, faced a situation in 2023 where its revenue growth was lower than the growth in lidar sales volume, with a year-on-year increase of 176.1% in lidar deliveries and a revenue increase of 56.1%, with a net loss of 480 million yuan last year.

Venture Capital Wind Vane

According to incomplete statistics from Tianyancha, a total of 70 investment and financing events occurred this week; looking at the distribution of financing rounds, angel rounds, Series A rounds, and strategic financing rounds are at the forefront, with 25, 8, and 7 events respectively; looking at the "number of times" investment institutions "stepped out," investment institutions have become more diversified, including institutions such as Tiantu Investment and Qiji Chuangtan, which are all on the list.

Among them, the medical and health industry had a total of 11 financing events; in terms of financing amount, Meili Weiye's financing amount exceeded 100 million yuan; in terms of investment institutions, institutions including Junshi Venture Capital and Xi Chuangtou have made investments.

This week, the artificial intelligence industry had a total of 5 financing events; in terms of financing amount, Xinshiqi Autonomous Vehicle's financing amount exceeded 100 million yuan; in terms of investment institutions, Shenggangtong Capital and Changshu Guofa Venture Capital have records of investment.

The advanced manufacturing industry had a total of 11 financing events; in terms of financing amount, Deyan New Energy, Xinqing Technology, Zongwei Technology, and Changxin Storage's financing amounts exceeded 100 million yuan; in terms of investment institutions, BYD and GigaDevice have made investments.

The automotive and transportation industry had a total of 5 financing events; in terms of financing amount, Shi De Technology, Botai Internet of Vehicles, and Xingqu Technology's financing amounts exceeded 100 million yuan; in terms of investment institutions, Northern Light Venture Capital and Man Teng Industry have made investments.

Join the Discussion