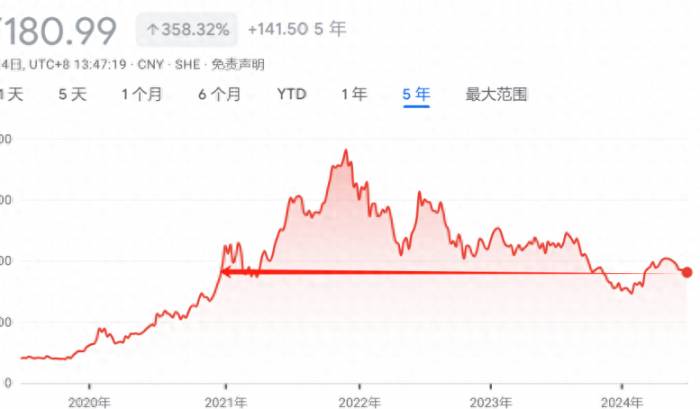

The AI wave is in full swing, among which AI-related Asian stocks have performed well. As Asian AI stocks continue to rise, discussions about their future trends have become increasingly heated. On July 2, HSBC analyst Herald van der Linde and others released a research report stating that they are cautiously optimistic about Asian AI stocks, considering that demand is lower than expected, market regulatory challenges and uncertainty in rising momentum. The report mentioned that the difference between the concept of artificial intelligence this time and other "market stories" is that there is a clear starting point: the release of ChatGPT. The subsequent AI wave gradually spread from the US stock market to the Asian market, which is why Asian AI stocks have risen so fast this time. The Taiwan stock market may be most affected by AI HSBC emphasized in the report that it is still optimistic about AI stocks. The Asian AI stock index compiled by the bank has risen by 231% since November 2022, showing its strong upward momentum. Since the beginning of 2023, the Taiwan stock market has risen by 70%, of which TSMC has risen by 110%. But the report also added that although there is no clear sign that demand and returns for Asian AI stocks have peaked, risks are accumulating. According to FactSet data, analysts have given a "buy" rating to 88% of Asian AI stocks, of which more than 15% have had their target prices raised, down from 21% at the beginning of the year. In terms of regions, HSBC maintains an underweight position on Taiwan's AI stocks, believing that the region is most affected by AI. Although the Korean stock market also has a large risk exposure, it holds an overweight position on the country's AI stocks. Four factors may drive a pullbackBy analyzing historical experience, HSBC has found that market rallies that rely on "big stories" to rise often correct due to the following four types of factors, which are also worth the vigilance of current Asian AI stocks.

First is the weakness in growth. That is, market demand cannot support growth expectations. For example, after the 2008 Beijing Winter Olympics, the stock prices of shoe manufacturers such as Li-Ning fell due to decreased demand.

Second is intensified market competition and tighter regulation. Take Amazon as an example, its stock price fell from $4.3 in 1998 to $0.3 in the third quarter of 2001, a drop of over 90%, due to rumors in the market that the company was about to go bankrupt because it could not compete.

The report also points out that the introduction of new regulations to curb monopolistic practices could also lead to a decline in industry growth. For instance, in June of this year, constrained by the EU's antitrust regulations and regulatory framework, Apple announced that it would delay the launch of its Apple Intelligence in the corresponding regions.

Third is the retraction of growth expectations. The report believes that companies that "tell stories" are often priced, not valued, meaning that how much a company's stock price can rise depends entirely on how much the market thinks it can rise.

The report indicates that the price-to-earnings (P/E) ratios of "big story" companies at their previous peak levels ranged from 21 to 82 times. Currently, the forward P/E high for Chinese internet stocks is 40 times, for Asian AI stocks it is 16 times, for TSMC it is 21 times, and for Aspeed it is 72 times, which are generally still below the peak levels of the previous "big story" market rallies, implying that there is still room for stock prices to rise.

Lastly is the risk from the companies themselves. The report indicates that this issue has not yet emerged in the Asian AI stock sector, but vigilance is still required.The report also added that bond yields are playing a role, and it is anticipated that bond yields will not rise sharply from current levels. Therefore, the development trajectory of Asian AI stocks may differ—specifically, the degree of contraction in their price-to-earnings ratios may be less than previously.

Join the Discussion