* Major stock indices fell across the board, with the Nasdaq plunging 3.64%;

* Safe-haven sentiment intensified, as the 2-year U.S. Treasury yield hit a five-month low;

* Ford's shares fell over 10% in after-hours trading due to earnings that missed expectations.

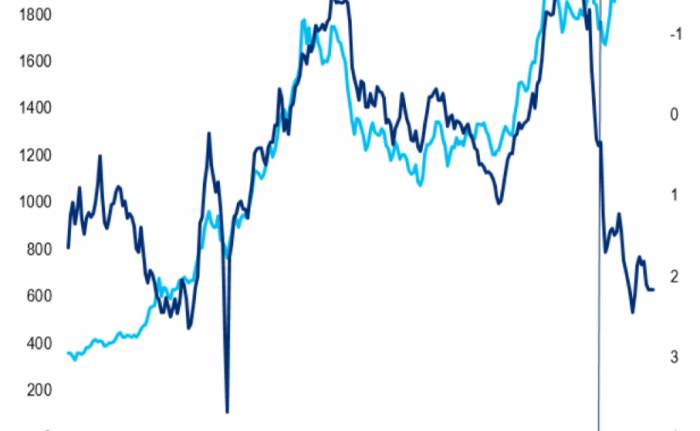

On Wednesday, U.S. stocks experienced a widespread decline, with underwhelming earnings reports from Google and Tesla dampening risk appetite. By the close, the Dow Jones Industrial Average fell 504.22 points, or 1.25%, to 39,853.87, the Nasdaq Composite plummeted 3.64% to 17,342.41, marking a new low since early June, and the S&P 500 index dropped 2.31% to 5,427.13, recording its largest decline since September 2022. The CBOE Volatility Index (VIX) surged 22% to 18.04.

Market Overview

On the individual stock front, Tesla plummeted over 12%, marking its biggest drop since September 2020, with its market value erasing over $80 billion. The latest financial report indicated that price reductions and promotions led to the company's profit margins hitting a near five-year low.

Alphabet Inc., the parent company of Google, saw its stock price drop 5%, reaching a new low since May 31. Investors noted a slowdown in the growth of its advertising business. Tesla and Alphabet respectively dragged down the S&P 500 communication services and non-essential consumer goods industry indices by 3.8% and 3.9%.

Other major tech stocks also performed poorly, with Apple, Microsoft, Amazon, Meta, and Nvidia seeing declines ranging from 2.9% to 6.8%.

In terms of economic data, figures released by the U.S. Department of Commerce on Wednesday showed that new home sales fell 0.6% in June, with the seasonally adjusted annual rate at 617,000 units, the lowest level since November of the previous year, due to the pressure on demand from rising mortgage rates and prices.

Data from S&P Global indicated that the U.S. Markit manufacturing PMI for July fell back into contraction, reaching a seven-month low, while the services and composite PMIs came in better than expected at 56.0 and 55.0, respectively, both hitting new highs in over two years.Investors will closely monitor the second quarter GDP data on Thursday and the Federal Reserve's preferred inflation indicator, the PCE, on Friday to assess the future policy outlook. Federal funds rate futures indicate that the market expects the Fed to cut rates by 25 basis points in September and to cut rates twice this year.

As the stock market plummeted, the CBOE Volatility Index (VIX), known as the "fear gauge," soared to 18.46 at one point, the highest level since late April. The risk-averse sentiment also pushed the yield on two-year U.S. Treasuries to a nearly five-month low. Trade Alert data shows that options trading volume for the VIX has doubled from usual levels. The sell-off has sparked concerns about overvaluation, reminiscent of the internet bubble more than two decades ago.

James St.Aubin, Chief Investment Officer at Sierra Mutual Funds, said: "This is the curse of high expectations during earnings season, especially for technology companies that have always been the darlings of the market."

Nevertheless, some analysts believe that the decline so far has not been entirely out of control. Matthew Tym, head of equity derivatives trading at Cantor Fitzgerald, said that despite recent volatility, the strong returns from the stock market over several months may put investors in a favorable position to withstand a slight increase in volatility.

In other stock news, AT&T rose 5.2% on expectations of user growth and maintained its full-year performance guidance.

Ford's shares plummeted more than 10% after hours as the earnings report showed an adjusted earnings per share of $0.47 for the second fiscal quarter, while the market expected $0.67.

International oil prices rebounded, with U.S. crude oil inventories falling for the fourth consecutive week. The nearest month contract for WTI crude oil rose 0.82%, to $77.59 per barrel, and the nearest month contract for Brent crude oil rose 0.86%, to $81.71 per barrel.

Safe-haven sentiment boosted gold prices. The COMEX gold futures contract for delivery in July on the New York Commodity Exchange rose 0.36%, to $2,413.30 per ounce.

Join the Discussion