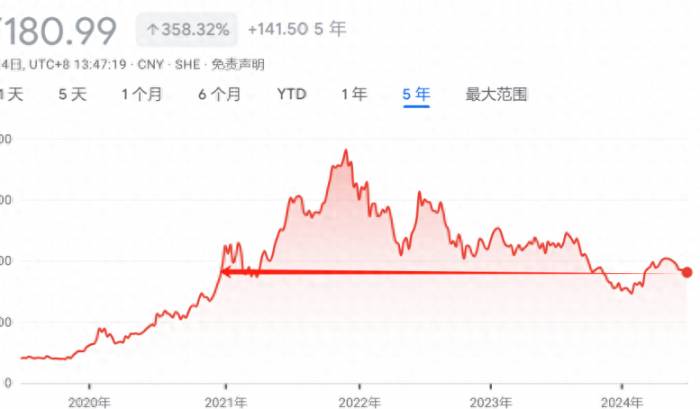

As of the close on March 29, the three major A-share indices collectively retraced this week (from March 25 to March 29), with the Shanghai Composite Index falling by 0.23%, the Shenzhen Component Index by 1.72%, and the ChiNext Index by 2.73%.

► Top Performing and Underperforming Stocks of the Week | 15 Stocks Surge Over 40%, Xiaomi Automobile Concept Stocks Rise Over 60% in a Week

Wind data indicates that a total of 15 individual stocks increased by more than 30% this week (from March 25 to March 29).

Jinrong Tianyu, a concept stock related to Xiaomi Automobile, led the week with a 64.30% increase. The buzz around Xiaomi Automobile remains high, and on Thursday evening, Lei Jun announced the official launch of the Xiaomi SU7, starting at a price of 215,900 yuan. Jinrong Tianyu's stock price achieved two consecutive trading days of "20cm" limit-up on the 25th and 26th. The company's main business includes precision automotive components, and as previously stated, it has secured supporting business for new energy vehicle products such as Xiaomi's.

Huasheng Technology, with a 7-day limit-up streak, accumulated a 61.06% increase this week. On Friday evening, it released an announcement regarding unusual market activity, stating that the company has noticed discussions on some media platforms and stock forums about its related businesses, involving hot concepts like low-altitude economy and parachutes. After self-inspection, the company has not been involved in low-altitude economy or parachute-related businesses. Its main products are currently divided into two major categories: airtight materials and flexible materials, which are not related to parachute materials. The company's daily operations and internal management order are normal. The recent significant increase in the company's stock price may involve the risk of irrational speculation.

On the list of the largest declines, 28 individual stocks fell by more than 20% this week, with Xinhai Retreat experiencing a 71.79% drop, and Delisting Bo Tian falling by 50%. Additionally, Dongli Xinke, Dingtong Technology, and Wei Chuang Shares also saw significant declines.

► The List of the Top Ten Active Stocks of the Week is Out, with 66 Stocks Accumulating a Turnover Rate Over 100%

This week, a total of 66 individual stocks had a turnover rate exceeding 100%. Among them, Anbang Guard ranked first with a weekly turnover rate of 248.46%; Jinrong Tianyu had a weekly turnover rate of 238.98%. Furthermore, stocks like Du Ke Culture, Shangluo Electronics, and Sanlian Forging also had high turnover rates.

Looking at the industry classification by Shenwan's first-level industry categories, among the stocks with a turnover rate of over 100% this week, those in the electronics, communications, and mechanical equipment industries were the most prevalent.

Regarding the weekly price change, among the stocks with a turnover rate over 100%, Jinrong Tianyu, Lei Ao Planning, and Ge Bi Jia saw the largest increases. Jinrong Tianyu achieved "20cm" limit-up on two trading days this week, with a weekly increase of 64.3%. The company stated on the 26th that there are no significant matters concerning the company that should be disclosed but have not been disclosed, or significant matters under planning by the company, its controlling shareholders, and actual controllers, or shareholders holding more than 5% of the shares.► Main Forces of the Week | Computer Sector Sees Significant Outflows, Seres Sells Nearly 3 Billion Yuan

According to the first-level industry classification by Shenwan, during the five trading days of this week, only the non-ferrous metals and petroleum and petrochemical sectors saw net inflows from the main forces. On the outflow side, the computer, media, electronics, automotive, and communications sectors had the highest net outflows, with the computer sector's net outflow amounting to nearly 19 billion yuan.

In terms of individual stocks, Inspur Information Technology led the week with a net inflow of 1 billion yuan, while Zijin Mining, Everwin Technology, and Sany Heavy Industry saw main force net inflows of 838 million yuan, 710 million yuan, and 570 million yuan, respectively. On the outflow side, Seres, Sugon, China Online, iSoftStone, and Jiangsu Changjiang Electronics Technology saw the highest net outflows, with Seres being sold off for 2.829 billion yuan.

► Northbound Capital of the Week | "Smart Money" Buys Over 5 Billion Yuan This Week, Two Stocks See Over 900 Million Yuan in Purchases

According to Wind statistics, northbound capital accumulated a net purchase of 5.381 billion yuan this week, with Shanghai-Shenzhen Stock Connect purchasing a net of 6.898 billion yuan and Shenzhen-Hong Kong Stock Connect selling a net of 1.517 billion yuan. As of March 29, northbound capital has a total net purchase of 21.985 billion yuan for the month.

Looking at the active individual stocks in the past week, China Merchants Bank and Wuliangye both saw net purchases over 900 million yuan, while Changan Automobile, iFLYTEK, and Sany Heavy Industry saw net purchases of 549 million yuan, 546 million yuan, and 545 million yuan, respectively. Mindray Medical Equipment was sold off for over 600 million yuan, leading the pack, while Seres, Goertek, and Jiangsu Changjiang Electronics Technology were sold off for 475 million yuan, 405 million yuan, and 365 million yuan, respectively.

► Leverage Capital's Heavy Holdings This Week Revealed, CITIC Securities Leads

Wind statistics show that this week (March 25 to March 29), a total of 1,635 individual stocks received net purchases from margin financing, with 456 having net purchases over 10 million yuan, and 27 having net purchases exceeding 100 million yuan.

CITIC Securities led the week with a net purchase of 483 million yuan in margin financing. GX Technology, Inspur Information Technology, and Everwin Technology were among the top net purchasers, with amounts of 466 million yuan, 388 million yuan, and 272 million yuan, respectively; Sugon, China Merchants Bank, and Cambricon-U saw the highest net sales, with amounts of 452 million yuan, 361 million yuan, and 283 million yuan, respectively.

► The Latest Institutional Research Route Map is Out, Jinzai Food is the Most Focused

(The translation ends here as the original text provided was incomplete.)Wind data shows that institutions surveyed a total of 158 listed companies this week (from March 25th to March 29th), among which Jinzai Food attracted the most attention, with 238 institutions participating in the research. Tianci Materials and Guanglianda were respectively surveyed by 210 and 205 institutions. In addition, Xie Chuang Data, Satellite Chemical, and Jinhong Gas all received research from over a hundred institutions.

According to statistics, Huanlejia was surveyed by institutions 4 times, while Binglun Environment, Shuanghui Development, Shennan Circuit, Shennan Expressway, and CIMC Vehicles were all surveyed 3 times.

Looking at the industries surveyed, institutions continue to focus on sectors such as basic chemical industry, industrial machinery, electronic components, and biotechnology.

Join the Discussion