In the past three trading days, the Japanese stock market has suffered three consecutive declines, and this week has seen a "Black Monday," which has led to a collapse in the Asia-Pacific stock markets. The Nikkei 225 index fell by more than 12% on Monday, and the Nikkei 225 Volatility Index also soared to a historically second-highest level of 70.69, with global risk capital flowing back to U.S. Treasury bonds.

JPMorgan Chase has warned that there may be an unknown "black swan" event in the market, as such a scale of selling in Japanese stocks would not typically occur without the impact of random events such as war, pandemic, natural disasters, or financial crises. In the next month, it is necessary to closely monitor the occurrence of historical political and economic turmoil that could place Japan at the "epicenter."

Overseas investors have been selling Japanese stocks since last week.

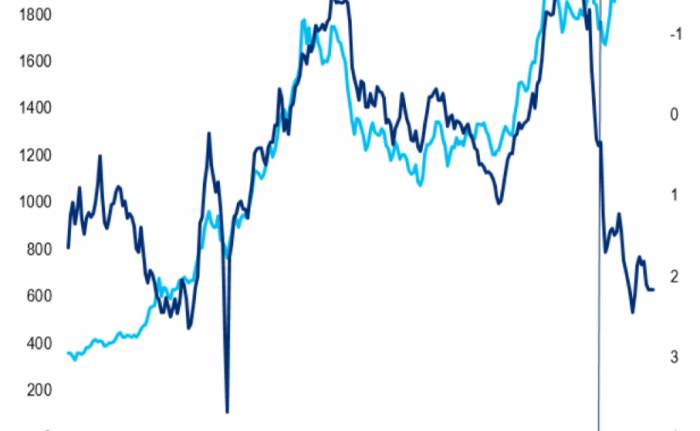

In a report released by JPMorgan Chase on the 5th, it was pointed out that last week (July 29 to August 2), the sell orders for MSCI Japan Index stocks expanded to 1.1 trillion yen. It is estimated that overseas investors have heavily liquidated in the spot market of Japanese stocks, having sold about 90% of the net purchases since the "Japanese stock craze" began in April 2023. The spot market for Japanese stocks is approaching the peak of selling. However, the position adjustment of CTA in the futures market is significantly lagging. If CTA completely clears its positions, the Nikkei 225 index may further decline to 27,000 points.

We believe that the spot market for Japanese stocks may be approaching a climax of selling. With the appreciation of the yen, the momentum effect of Japanese stocks is also rapidly weakening, and overseas investors and Japanese retail investors are heavily selling in the spot market for Japanese stocks.

Behind the chain of selling triggered by Japanese stocks is the accelerated selling by trend-following investors (retail investors, hedge funds, etc.) in the spot market for Japanese stocks, in addition to the widespread selling of leading Japanese stocks by overseas investors.

Is this round of Japanese stock collapse just the beginning of a bear market?

JPMorgan Chase also believes that the Japanese stock market may be approaching the early stage of a bear market: data shows that there is a chain reaction between the rise in stock correlations and the surge in volatility, which may trigger a "sell everything" situation.

During the period of overseas investor selling, the volatility of the Japanese stock market surged, and the Nikkei 225 Volatility Index (VI) reached 70.69, an extremely high level, even surpassing the periods of Japanese stock market volatility in 2011, 2018, and 2020, second only to the historical record of 92.08 on October 31, 2008.

Is the recent sharp decline in Japanese stocks a "black swan" event?JPMorgan Chase believes that the recent sharp decline in Japanese stocks is more like a "black swan" event:

Generally speaking, without black swan events such as wars, pandemics, natural disasters, or financial crises, the large-scale market chaos seen in Japanese stocks over the past three trading days would not typically occur.

However, we cannot rule out the possibility of a black swan event in the market, which cannot be observed from the surface of existing data and information.

We hope to closely monitor the occurrence of historical political and economic turmoil in Japan as a kind of "epicenter" over the next month.

The several major factors that have triggered the short-term collapse of Japanese stocks include:

The rapid deterioration of the supply and demand relationship in Japanese stocks, with a large number of long positions established based on momentum investment strategies being sold off, including CTA selling of Japanese stock futures, the sale of Japanese stock spot, and the yen carry trade, etc.;

Global risk capital flowing back to U.S. Treasury bonds (investors tend to shift funds to safer assets such as U.S. Treasury bonds in an uncertain market environment).

The effectiveness of the Bank of Japan's market intervention through the purchase of ETFs and other means is diminishing.

What might the future hold for Japanese stocks?

As for the future trend of Japanese stocks, JPMorgan Chase believes that if the Nikkei 225 index remains below 35,000, it will trigger further selling by CTAs.Starting from last week, CTAs have significantly driven the selling of Japanese stocks. CTAs have currently closed about 40% of their positions. If the Nikkei 225 index breaks below 35,000 points and the Topix index falls below 2,400 points, then CTAs will accelerate their stop-loss activities.

Should CTAs completely liquidate their positions, we believe that the Nikkei 225 index may further decline to the 27,000 point level.

It is crucial to observe whether the buying in the Japanese spot market will increase next. If the Nikkei 225 index fails to return to 35,000 points in August, we believe that the Japanese stock market may transition into a bearish trend phase, with CTAs closing out their futures long positions and beginning to seek opportunities to go short.

Join the Discussion