Over the past year, gold has accumulated a gain of over 21%, ranking at the top among various assets. Looking forward to the trend of gold in the future market, analysts at Citigroup, including Maximilian J Layton, proposed a new fundamental analysis framework in a report released this week. They believe that the proportion of investment demand to gold mining supply is the main driver of gold pricing. Over the past two years, central bank investment demand has continued to increase, accounting for a large part of mine supply, driving gold prices to rise continuously. It is expected that central bank gold purchases can support gold prices to stay steady at $2700-$3000 in the next market.

Central bank gold purchase demand reached 85% of mine supply in Q1, supporting the upward movement of gold prices. Analysts pointed out that investment demand can be seen as the distribution of wealth between the private and public sectors. This wealth distribution decision is not only affected by real interest rates but also by geopolitical factors (such as de-dollarization) and the risk of other asset prices.

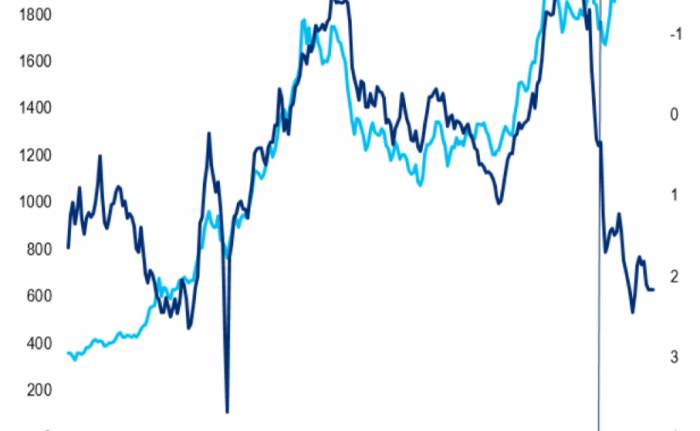

Since the third quarter of 2022, the performance of gold prices has begun to significantly deviate from the trend of U.S. real interest rates. Historical data shows that gold prices are usually negatively correlated with U.S. real interest rates. When real interest rates rise, the opportunity cost of holding gold increases, and funds tend to appropriately reduce their allocation to gold and increase their allocation to U.S. Treasuries and the U.S. dollar, thus gold prices usually fall; conversely, gold prices rise.

Analysts pointed out that this deviation that appeared in the second half of 2022 is because real interest rates are only one of the drivers of global gold investment demand. In fact, the negative impact of real interest rates on gold investment (mainly reflected in global ETF physical demand) has been offset by the surging and continuously rising global central bank investment demand since the middle of 2022:

The gold investment demand of global central banks, led by China, rose to 85% of mine supply in the first quarter of 2024, averaging over 70% of mine supply over the past two years (from the third quarter of 2022 to the first quarter of 2024), and only accounted for 25% of mine supply in the previous three years (from the third quarter of 2019 to the second quarter of 2022). The increase in global central bank investment demand offset the negative impact of rising U.S. real interest rates on gold prices, squeezed jewelry demand, and drove gold prices to historical highs.

The enthusiasm for gold purchases in the private sector is also continuing. Analysts expect that the strong demand for gold from the public sector may be a trend that lasts for decades. Under Citigroup's basic assumption, public sector gold demand will reach a historical high in 2024 and 2025, at 1100 tons and 1075 tons respectively. In an optimistic scenario, public sector gold demand in 2024 and 2025 could reach 1240 tons and 1225 tons respectively.

The report points out that the extent to which gold prices rise in the face of strong investment demand will largely depend on the elasticity of jewelry demand and scrap gold to prices. Compared to the gold bull market from 2008 to 2012, the reaction to high prices may be relatively moderate. Since 2022, despite high prices, jewelry demand has stabilized at about 2200 tons per year.In addition to central bank gold purchases, analysts believe that private sector demand for gold investments, including global retail physical gold bars and coins demand, global ETF demand, and OTC/other (net) demand, is also very strong, especially in China. Despite prices reaching or approaching historical highs so far this year, the level of buying remains high. In the first half of 2024, China's retail gold demand set a historical record.

Regarding ETFs, analysts expect that by the end of the year, as the Federal Reserve begins its rate-cutting cycle, ETFs will shift to buying and continue into the first half of 2025. It is projected that the net purchase for 2024 will be 50 tons (with a higher volume in the fourth quarter), with a base scenario of 275 tons for 2025 and an optimistic scenario of 400-500 tons.

Analysts anticipate that over the next 12-18 months, investment demand for gold will rise to a level that nearly absorbs all mined supply, supporting Citi's base case forecast for gold prices to reach $2,700-3,000 per ounce by 2025.

Citi points out that the next round of investment demand and price increases will come from the normalization of U.S. interest rates (Citi's U.S. economic team believes the Federal Reserve will start cutting rates in September for eight consecutive times), especially driving up ETF demand. With factors such as de-dollarization supporting it, it is expected that the global central banks' gold-buying trend will continue.

Join the Discussion