Publicly offered mutual funds have gradually disclosed their 2023 annual reports, bringing the full picture of net profits and management fees of fund products to light. According to First Financial, based on data from Wind, last year's publicly offered mutual funds collected a total of 135.657 billion yuan in management fees, a reduction of over ten billion yuan compared to the previous year, marking the industry's first "contraction" in nearly a decade.

At the same time, following a loss of 146 billion yuan the previous year, the overall publicly offered mutual fund products still failed to generate profits for their holders, with a combined net loss of 43.5118 billion yuan. The cumulative loss over two years has increased to 190 billion yuan. This implies that it will take time for the public mutual fund industry's reputation to rebound.

Management fee revenue exceeds 130 billion yuan

As of early April, the 2023 annual reports of publicly offered mutual funds have been essentially disclosed. First Financial, based on Wind data statistics, found that last year, 198 fund management companies in the public mutual fund industry collected a total of 135.657 billion yuan in management fees, a decrease of over ten billion yuan compared to 145.887 billion yuan in the same period of 2022.

From the perspective of growth rate, the poor profit effect combined with the wave of fee reduction led to a more than 7% decrease in management fees for publicly offered mutual funds in 2023, the first decline in the industry in nearly a decade. However, there has been a trend of deceleration in recent years, such as the management fee growth rate in 2022, which dropped from 52% in the previous year to 2.32%.

Currently, there are four fund companies with management fees exceeding five billion yuan, half the number compared to the same period last year. Among them, although the management fee revenue of E Fund has decreased for two consecutive years, it still ranks first among fund companies, reaching 9.274 billion yuan, a further decline of 8.64% compared to 10.151 billion yuan in 2022.

Similar situations have also occurred in other medium to large companies. For example, the second to fourth places are Guangfa Fund, Huaxia Fund, and Fullgoal Fund, with management fee revenues of 6.655 billion yuan, 5.974 billion yuan, and 5.455 billion yuan, respectively; Huitianfu Fund, Nanfang Fund, Harvest Fund, China Merchants Fund, and CEF Fund, with management fees all exceeding four billion yuan. However, these companies have all experienced a decrease in management fee revenue.

On one hand, the "ceiling" of management fee revenue for fund companies has been lowered, with no fund companies having management fees in the ten billion yuan range. On the other hand, the "top ten" have generally decreased, and the threshold has dropped from 4.332 billion yuan in the previous year to 3.695 billion yuan. This undoubtedly indicates a significant "contraction" in management fees for leading companies, especially those with a higher proportion of active equity funds.

According to First Financial statistics, among the 194 publicly offered mutual fund management companies with data from the past two years in the entire market, nearly half (48.97%) of the companies have experienced a decline in management fee revenue to varying degrees; among the 35 fund companies with management fees exceeding one billion yuan, the proportion of companies with reduced management fees is more than 70%.

Among these 35, ten companies have achieved year-on-year growth in management fee revenue, with three achieving double-digit growth rates. For example, Hua Shang Fund's management fee revenue in 2023 was 1.064 billion yuan, a 52.15% increase from 699 million yuan in 2022; the management fee growth rates for Huatai-PineBridge Fund and Wanjia Fund were 24.54% and 13.59%, respectively.As one of the main sources of income for fund companies, the general reduction in management fees may also be due to the reform of public funds. Since the reform of public fund fee rates was promoted on July 8th last year, it has been gradually extended from the leading companies. By the end of last year, the management fees for the vast majority of actively managed equity products (including common stock type, flexible allocation type, stock-biased hybrid type, and balanced hybrid type funds) have been adjusted. Wind data shows that the management fees for actively managed equity products last year were 61.175 billion yuan, a decrease of 12.857 billion yuan compared to the previous year.

However, overall, the income from public fund management fees still shows a "stronger forever" trend, but the proportion has decreased. Data shows that the total management fee income of the top 20 fund companies last year reached 84.077 billion yuan, accounting for about 61.97% of the total management fee income of all fund companies, a decrease of 2.32 percentage points from 64.29% the previous year.

A cumulative loss of 1.9 trillion yuan in two years

In addition to the revenue situation, the actual operating results of public funds last year were also disclosed with the annual report. Based on Wind data statistics by First Financial, under the extreme market conditions of last year's fluctuating market, the products under the management of public fund managers were once again "grounded", with a total loss of 435.118 billion yuan.

So far, public funds have been losing money for two consecutive years, with a cumulative loss of nearly 1.9 trillion yuan. This number is close to the annual profit (1.97 trillion) of the public fund industry in 2020 when it was at its "highlight moment". This also means that it will take time to restore investors' confidence in entering the market through funds.

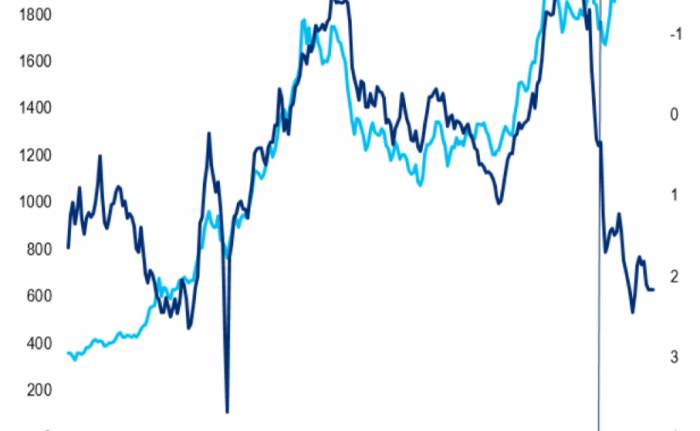

Looking back at last year's A-share market, following the turbulent market of 2022, the market in 2023 is still moving forward with hesitation, and the Shanghai Composite Index continues to adjust and decline, mostly hovering below 3000 points in the fourth quarter. Data shows that by the end of December, the Shanghai Composite Index was fixed at 2974.93 points, with a year-low of 2882.02 points, and the annual decline reached 3.7%.

Under the bleak market, the profit effect is relatively limited, and equity products related to the stock market naturally have no dazzling performance. According to the statistics of First Financial, according to the first-level classification of funds, hybrid funds were the products with the most losses last year, with a net profit of -57.8979 billion yuan for the year; and stock funds also lost 32.4561 billion yuan for the year.

The reporter noticed that in the first quarter of last year, equity products were still the mainstay of profits, with a combined profit of more than 20 million yuan. However, starting from the second quarter, many fund products have already given up their early profits and turned from profit to loss. In terms of a single quarter, these two types of products have lost more than 10 million yuan in the last three quarters.

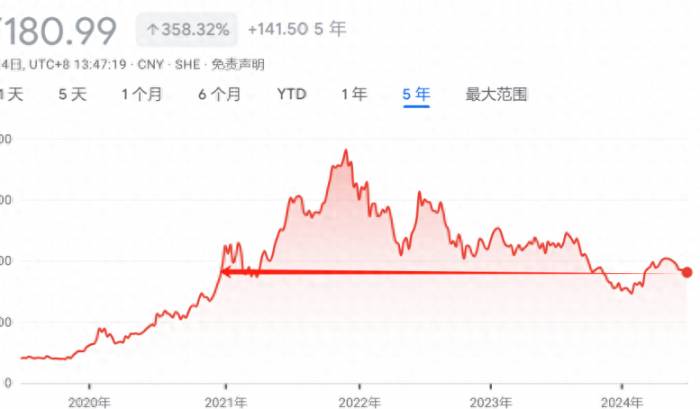

As the "hard hit area" of the previous year, actively managed equity funds still "suffered heavy losses" last year, with only one-tenth of the fund products making a profit. Wind data shows that the total loss of 4250 actively managed equity funds (only calculating the initial funds) in 2023 reached 67.35 billion yuan.

At the same time, fixed-income products maintained a "stable output" and once again contributed the vast majority of profits. Specifically, bond funds made a profit of 24.3199 billion yuan for the year in 2023, followed by money market funds with 23.0859 billion yuan. In last year's market, these two types of products made a profit of 3.6 billion to 8 billion yuan each quarter.From the perspective of public fund managers, the profitability situation has improved compared to the same period last year. According to statistics from First Financial, out of the 197 fund managers with available data, 100 fund companies achieved positive returns for their holders in 2023, accounting for more than half; while this number was 64 for the same period last year; the upper limit of earnings also increased from 2.377 billion yuan to 8.747 billion yuan.

Overall, fund companies with a higher proportion of fixed-income products performed at the forefront.

Data shows that last year, there were 22 companies that made more than 1 billion yuan for their holders, with 6 exceeding 5 billion yuan. Specifically, Bosera Fund and CCB Fund were the best-performing companies in terms of profit last year, with profits of both companies' products exceeding 8.7 billion yuan.

Xingye Fund and BOC Fund followed with profits of 6.956 billion yuan and 6.925 billion yuan, respectively; while the profits of products under Yongying Fund and PuYin AnSheng Fund exceeded 5 billion yuan. In addition, the products of China Life Security Fund, Ping An Fund, Shanghai Bank Fund, and Sino-Canada Fund earned more than 4 billion yuan in profits.

Join the Discussion