After missing out on NVIDIA, this big dark horse, Masayoshi Son is finally gearing up for AI.

According to insiders, SoftBank has recently been in talks with banks to raise $10 billion for investing in energy-related projects, while also exploring how to purchase a large number of NVIDIA GPUs. According to SoftBank's plan, it will first establish a Special Purpose Vehicle (SPV), then the SPV will borrow money from banks to buy GPUs and invest in energy projects, and then lease the GPUs back to SoftBank. This loan structure ensures that SoftBank can keep the debt off its balance sheet.

This means that as one of the world's largest technology investors, SoftBank hopes to increase its investment in AI infrastructure and get a share of the profits.

Due to the surging electricity demand of AI data centers, SoftBank's interest in energy is growing day by day, including new energy sources such as solar and nuclear power.

Son said in June: "Although the progress of chips and data centers has accelerated the development of artificial intelligence, one of the biggest bottlenecks will be electricity. Innovations in the fields of renewable energy and nuclear fusion can provide new sources of power."

The insider said that SoftBank will ensure the funding for energy-related investments through bank loans and by introducing other investors.

At the same time, SoftBank has also started building data centers. Last month, SoftBank announced plans to build a large-scale AI data center in Osaka, Japan, which can be said to be blooming in multiple directions in the field of AI.

After all, Son is very regretful about missing out on NVIDIA, this big dark horse of the AI wave.

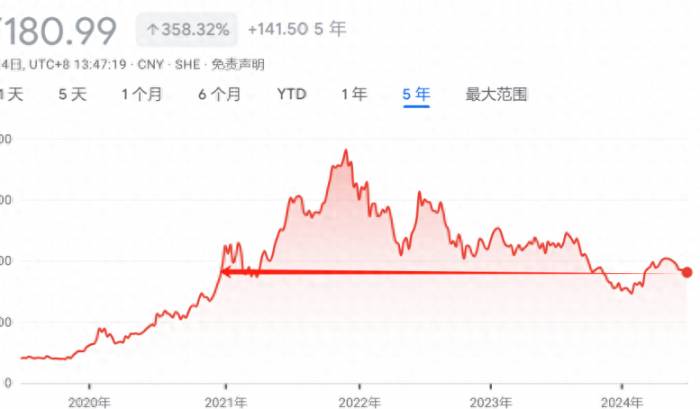

On June 21, Son reviewed a major mistake in his investment career at SoftBank's annual shareholders' meeting: he sold NVIDIA stocks too early, missing out on potential profits of up to $150 billion.

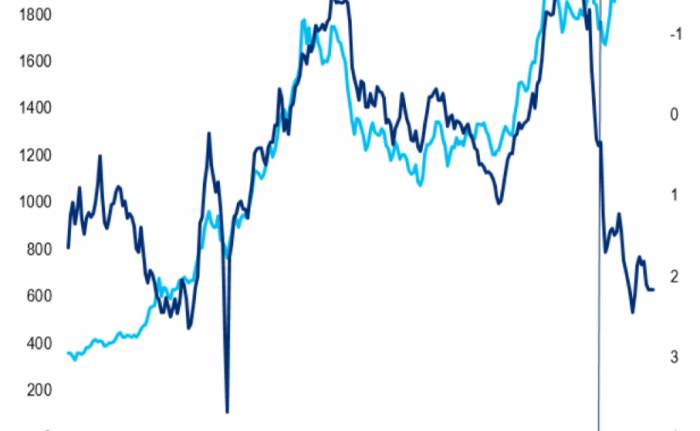

Thinking about the things I missed is really frustrating. I really regret selling NVIDIA stocks.It is reported that in 2019, SoftBank sold all of its 4.9% stake in NVIDIA and obtained an investment return of $3.3 billion. At that time, Masayoshi Son believed that locking in the returns was a wise move, as SoftBank's cost for purchasing NVIDIA shares was only $700 million. If SoftBank had held onto NVIDIA, the value of its shares would be $160 billion today. This means that SoftBank missed out on over $150 billion in gains when it liquidated its NVIDIA holdings in 2019.

It is only natural that he does not want to miss the next development opportunities in AI.

In the wave of AI startup financing over the past year and more, Masayoshi Son and the SoftBank Vision Fund have largely stayed on the sidelines, not participating in the investment of AI unicorns Anthropic and Cohere. Some insiders have revealed that part of the reason is valuation issues, and another part is that SoftBank has not received clear instructions from the leadership to lay out AI. The potential reason may be to maintain a friendly relationship with OpenAI, as both Anthropic and Cohere are competitors of OpenAI.

The insider also stated that Masayoshi Son even prevented the SoftBank Vision Fund from participating in the investment of the open-source model developer Mistral, because he believed it might jeopardize SoftBank's relationship with OpenAI. This also implies that Masayoshi Son has sent a signal to the Vision Fund team: that it should not continue to invest in large language models that may compete with OpenAI. This is because Masayoshi Son had previously communicated with OpenAI CEO Sam Altman about collaborating on the development of AI hardware devices.

From these clues, one can also speculate why Masayoshi Son did not directly enter the development of large models, but first thought about laying out power and data centers.

Join the Discussion