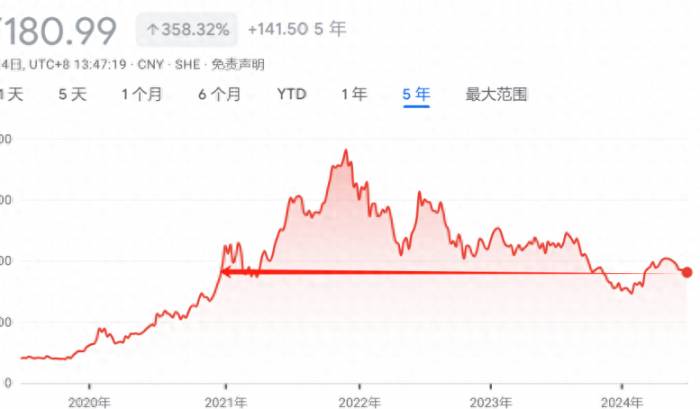

The domestic PD-1 market is highly competitive, and Junshi Biosciences (688180.SH), despite being the first domestic manufacturer of PD-1 monoclonal antibody drugs, is still in a continuous state of loss.

The latest disclosed performance report for 2023 shows that Junshi Biosciences achieved a total operating revenue of 1.503 billion yuan for the year, a year-on-year increase of 3.38%; the net profit attributable to shareholders of the listed company was -2.28 billion yuan, a reduction in loss of 104 million yuan compared to the previous year.

The main reason for Junshi Biosciences' continuous loss is the persistently high level of R&D investment. Its core product, Toripalimab, was approved in 2018 and was the first domestic PD-1 monoclonal antibody to be marketed in China, but its sales volume is not particularly outstanding among all domestic PD-1 monoclonal antibodies. To improve profitability, Junshi Biosciences has been continuously expanding new indications for Toripalimab in recent years and is actively developing innovative drugs in other fields.

Core product revenue growth but still not enough to cover expenses

Junshi Biosciences currently has three products that have been commercialized: Toripalimab (TuoYi®), Deuterated Bromide Hydrobromide Tablet (MinDeWei®), and Adalimumab (JunMaiKang®). Among them, Deuterated Bromide Hydrobromide Tablet is mainly indicated for mild to moderate COVID-19, with relatively limited short-term market prospects; Adalimumab is mainly for autoimmune diseases such as rheumatoid arthritis, and its overall sales scale since its launch has been limited, with 2023 sales likely not exceeding 300 million yuan; the anti-tumor drug Toripalimab, as the company's core product, saw a year-on-year increase in sales revenue of 24.93% in 2023, reaching 919 million yuan.

Although product sales revenue has increased, the high operating expenses still lead to a deficit for the company, which remains in continuous loss.

During the reporting period, the company's total R&D investment reached 1.937 billion yuan, a decrease of 18.74% compared to the previous year, and its proportion of revenue also significantly decreased, but it is still much higher than the company's overall revenue level, reaching 128.95% of revenue.

At the same time, due to increased market promotion efforts, the company's operating costs and sales costs increased by 7.27% and 17.98% year-on-year, reaching 541 million yuan and 844 million yuan, respectively.

Overall, the persistently high level of R&D investment is the main reason for the company's continued loss. This reflects, to some extent, its anxiety about the current sales situation of Toripalimab and its commitment to developing new growth points.

Continuously increasing R&D efforts to seek new growth pointsSince 2018, more than ten PD-1 products have been successively approved for marketing in China, with the industry competition remaining fierce. In 2023, according to the annual reports disclosed by various pharmaceutical companies, the sales of PD-1 products such as BeiGene, Innovent Biologics, Henlius, and Kangle Biopharma have all exceeded the 1 billion yuan mark. Among them, BeiGene's tislelizumab achieved a full-year sales of 3.806 billion yuan, taking the lead.

In contrast, Junshi Biosciences' toripalimab has shown a steady sales performance since its launch, without demonstrating a significant first-mover advantage compared to later-launched domestic PD-1 products.

Lin Wei, fund manager at Qingqiao Sunshine Fund, told Yicai that after a long period of exploration, the boundaries of PD-1/PD-L1 monoclonal antibodies in tumor treatment have been basically determined, and the domestic industry pattern has gradually taken shape. Compared to the first-mover advantage, the potential demand for indications and the capabilities of the sales team are the keys to the core competitiveness of PD-1/PD-L1 monoclonal antibody products.

Toripalimab was included in the medical insurance catalog in 2020, and since then, the overall price has dropped significantly, from the initial 7,200 yuan to 1,912.96 yuan, and the product's gross margin has also decreased from around 88% in 2020 to about 70% currently, greatly affecting the profitability of the product. As of 2023, the sales revenue of toripalimab has not yet returned to the level of 2020.

To further enhance the competitiveness of the product, Junshi Biosciences has been continuously promoting research on new indications for toripalimab in recent years. Currently, there are more than 40 indication studies on toripalimab globally, covering 15 indications, including lung cancer, nasopharyngeal carcinoma, esophageal cancer, gastric cancer, bladder cancer, breast cancer, liver cancer, kidney cancer, and skin cancer. Domestically, 7 indications have been approved for marketing.

Junshi Biosciences has also been continuously strengthening the promotion of toripalimab in overseas markets. In October 2023, toripalimab in combination with cisplatin/gemcitabine was approved by the FDA for the first-line treatment of adult patients with metastatic or recurrent locally advanced nasopharyngeal carcinoma in the United States. In addition, the marketing authorization applications for toripalimab as a first-line treatment for nasopharyngeal carcinoma and esophageal squamous cell carcinoma have been accepted by the European Medicines Agency and the UK Medicines and Healthcare products Regulatory Agency, and are under review.

Junshi Biosciences has also successively partnered with Hikma, Dr. Reddy's, and Kanglianda Shengji, among others, to carry out commercial cooperation in more than 50 countries in the Middle East, North Africa, Latin America, and Southeast Asia.

On the other hand, in view of the continuous congestion in the field, Junshi Biosciences has also been sparing no effort in promoting the research and development of other new drugs in recent years. To date, the company has nearly 30 research projects in the clinical stage, covering fields other than oncology, including autoimmune diseases, chronic metabolic diseases, neurological diseases, and infectious diseases. Among them, some drugs such as JS002 (Ongoriximab) and JS005 (Recombinant Humanized Anti-IL-17A Monoclonal Antibody) have entered Phase III clinical trials for their indications.

Affected by this, the company's R&D expenditure has remained high in recent years, often exceeding its overall revenue level, and cash consumption has been unusually rapid. In 2023, Junshi Biosciences' cash and cash equivalents at the end of the period were 3.788 billion yuan, a decrease of 2.2 billion yuan from the beginning of the year, down 37.19%. R&D investment and asset construction are the main uses.

Currently, Junshi Biosciences has begun to streamline its R&D team, with the number of researchers decreasing by 259 compared to the previous year, but the pressure to control costs remains huge, and the time for Junshi Biosciences to explore new growth points is becoming increasingly urgent.

Join the Discussion