After a gap of three months, the Japanese stock market has finally regained its upward momentum. The Nikkei 225 index broke through the 40,000 mark again on Tuesday, and the Topix index also approached a thirty-four-year high last week.

On Wednesday, the Japanese stocks continued to rebound. The Nikkei 225 index closed up by 1.3%, and the Topix index ended up by 0.5%. Over the past five trading days, the two major stock indices have cumulatively risen by 3.3% and 2.8%, respectively.

Behind the rebound of Japanese stocks is the fact that foreign capital and retail investor holdings have both set historical records. On one hand, due to the positive outlook for the end of deflation, loose monetary policy, and improvements in corporate governance, overseas funds have been pouring into Japan in large amounts. On the other hand, the previous rise in Japanese stocks has significantly boosted public confidence, and the stock split of listed companies has also lowered the threshold for retail investors to enter the market.

Japanese ETFs have also seen a substantial inflow of funds and have risen collectively last week. However, due to the sharp depreciation of the yen, some ETFs that have not hedged exchange rate risks have underperformed the broader market.

Japanese Stocks See Record Holdings by Foreign Investors and Retail Investors

A survey released by the Tokyo Stock Exchange on Tuesday showed that the number of individual shareholders of companies listed on the four major Japanese stock exchanges increased by 4.62 million in the fiscal year 2023, reaching a record 74.45 million.

The increase in the number of retail investors is not only due to the stimulus of rising stock prices, but also because companies such as Nippon Telegraph and Telephone Corporation (NTT) have implemented stock splits, which have reduced the price per share, making it easier for individuals to purchase stocks.

The survey also revealed that about 2.47 million individuals have become new shareholders of companies that have implemented stock splits. This includes more than 1.06 million new shareholders added by NTT (which carried out a 25:1 stock split), approximately 110,000 new individual shareholders added by Oriental Land, the operator of Tokyo Disney Resort, and Mitsubishi Corporation, a trading company.

Furthermore, the new Japanese Individual Savings Account (NISA) tax-exempt plan, which began in January of this year, has also contributed to the increase in the number of individual investors. The plan is targeted at small investors.

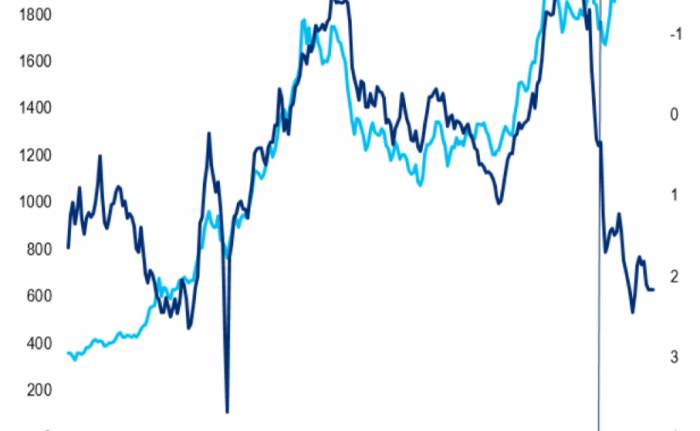

While the number of domestic retail investors has soared, the proportion of Japanese stocks held by foreign capital reached a historical high last year.Data released by the Japan Exchange Group on Tuesday shows that in the fiscal year ending in March, the total value of stocks held by foreign capital accounted for 31.8%, the highest level since comparable data has been available since 1970. In 1970, this proportion was only 4.9%. Individual investors accounted for 16.9%, while financial institutions accounted for 28.9%.

Additionally, in the previous fiscal year, foreign purchases increased to 320 trillion yen ($2 trillion), growing by over 40% from a year ago. They became net buyers for the first time in three years, with a cumulative net purchase of 7.7 trillion yen.

Echoing the rise in the overall market, exchange-traded funds (ETFs) focused on Japan also saw a significant inflow of funds, with a collective increase of over 2% last week.

Among them, the iShares MSCI Japan Euro Hedged UCITS ETF (IJPE) accumulated a 3.44% increase last week, while the Amundi MSCI Japan ESG Climate Net Zero Target CTB UCITS ETF (CJ1P) rose by 2.42%. Both ETFs benefited from the positive outlook brought about by market gains, reduced volatility, and stable inflation.

However, it is noteworthy that although Japan-related ETFs have all risen significantly, there is a huge performance gap.

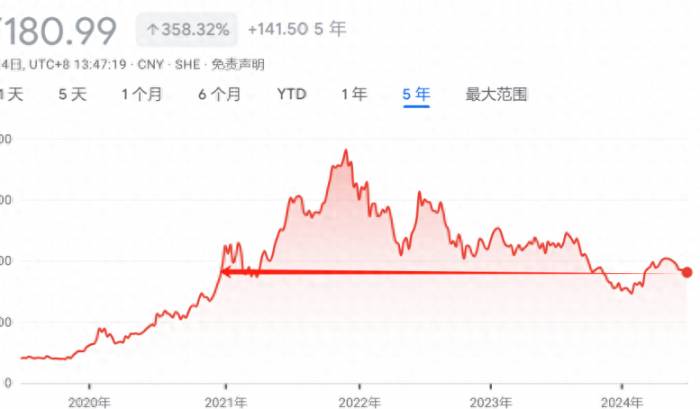

Take the EWJ and HEWJ under BlackRock's iShares as an example. Over the past year, the Nikkei has risen by about 20%, while the EWJ return was around 10%, and the HEWJ return was around 30%.

Some analysts believe that currency hedging is the main reason for the performance divergence of ETFs. The EWJ tracks the MSCI Japan Index, with holdings mainly in Japanese company stocks, while the HEWJ is the currency-hedged version of the EWJ, with over 90% of its holdings in EWJ, along with U.S. dollar cash, yen-to-U.S. dollar forward contracts, and U.S. dollar money market funds.

Due to high U.S. dollar interest rates and slow yen rate hikes, there is a significant interest rate differential between the U.S. and Japan. Over the past year, the yen has plummeted by more than 12% against the U.S. dollar, and last week it even broke through the 160 mark, reaching a new low since December 1986. As of the time of writing, the yen-to-U.S. dollar exchange rate is trading at an even lower position of 161.79.

Therefore, if an ETF does not hedge its currency exposure, the sharp decline in the yen would significantly offset the gains brought about by the rise in Japanese stocks.

Join the Discussion