Ever since the Federal Reserve hinted at the possibility of interest rate cuts last fall, Wall Street traders, economists, potential homebuyers, and car buyers have all been grappling with a single question: When will the Fed begin to cut rates? At the end of last year, due to the rapid decline in U.S. inflation, the market bet that the Fed would aggressively cut rates, with the first cut in March this year and a total of seven cuts within the year.

However, with the U.S. economy showing surprising vitality, the market has shifted its focus to another question: Can the Fed still deliver the three rate cuts suggested by the dot plot this year? Or, will the Fed cut rates at all within the year? Investors in U.S. stocks and bonds have also begun to adjust their investment strategies.

The market is now betting on the possibility of no rate cuts by the Fed this year.

Following the unexpectedly strong non-farm employment data last week, the CME FedWatch Tool showed that the market's expectation for the first rate cut by the Fed in June has dropped from 55.2% a week ago to 50.8%. If the latest Consumer Price Index (CPI) data to be released on April 10th again exceeds expectations, this expectation could fall below 50%. The market currently estimates that the core CPI for March will rise by 0.3% month-on-month, a pace that is obviously too fast for the Fed.

Some market participants are now suggesting that the Fed may not cut rates this year.

Torsten Slok, Chief Economist at Apollo Global Management, a wealth management firm, analyzed that over the past five months, the U.S. stock market has risen by $10 trillion, which represents a significant increase in household balance sheets. Credit spreads for investment-grade, high-yield bonds, and loans have tightened. The issuance of investment-grade and high-yield bonds rebounded sharply in the first quarter of this year. IPO and M&A activities are also returning. These factors will support consumer spending, capital expenditure, and hiring in the coming quarters.

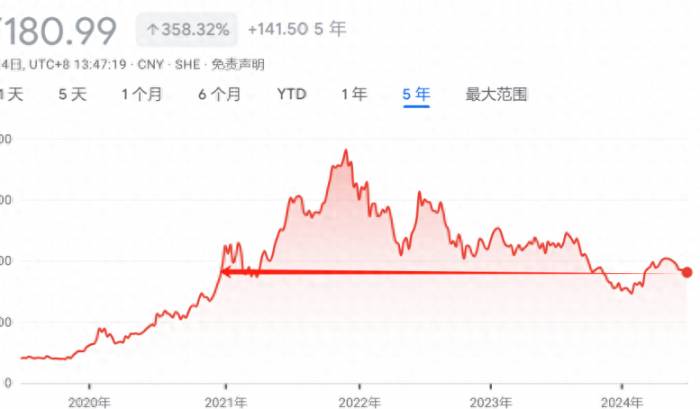

"If the economic data remains too strong, why should we cut rates? I believe the Fed will not cut rates this year, and maintaining high long-term interest rates is the correct answer," Slok added. He also noted that the fervor for artificial intelligence (AI) stocks will make it difficult for the Fed to cut rates, "We are definitely in an AI bubble, and its side effect is that the rise in tech stocks will ease financial conditions, making Fed decision-making more challenging."

Ed Yardeni, President and Chief Investment Strategist at Yardeni Research, a sell-side research firm, also wrote in a report: "Investors may have to consider the possibility of no rate cuts this year. The recent rise in oil prices represents an ongoing risk of inflation." Others who expect no rate cuts this year include Mohamed El-Erian, Chief Economic Advisor at Allianz Group. El-Erian stated that due to the stickiness of inflation, the Fed should wait "a few years" before cutting rates.

In addition, Slok warned that U.S. banks have previously indicated that if the Fed does not cut rates for the first time in June, the first rate cut may be postponed until next year, as rate cuts in the second half of the year will be more difficult with the 2024 presidential election approaching in the latter half of 2024.

In fact, it's not just market participants; Fed officials have also become more "hawkish." Last week, several Fed officials emphasized that there is little need for rate cuts in the short term. On the contrary, the Fed needs more information about the direction of economic development.Dallas Federal Reserve President Lorie Logan stated: "It is premature to consider a rate cut at this time. I need more clarity on which path the U.S. economy is currently on." Atlanta Federal Reserve President Raphael Bostic expressed that he favors only one rate cut this year, and it should be delayed until the last three months. Minneapolis Federal Reserve President Neel Kashkari questioned last Thursday: "If we continue to see strong job growth, consumer spending, and robust GDP growth, then I have a question, why should we cut rates?" U.S. stocks fell on the day of the news. Federal Reserve Governor Bowman expressed a more aggressive view on Friday, stating that if U.S. inflation remains higher than the Federal Reserve's 2% long-term target, it may be necessary to further raise interest rates rather than cut them this year. "Although this is not my base expectation, I still believe that at future meetings, if inflation stagnates or even reverses, we may need to further raise the policy interest rate," she said.

U.S. stock and bond investors adjust investment strategies.

With this shift in expectations, U.S. stock investors quickly increased risk hedging.

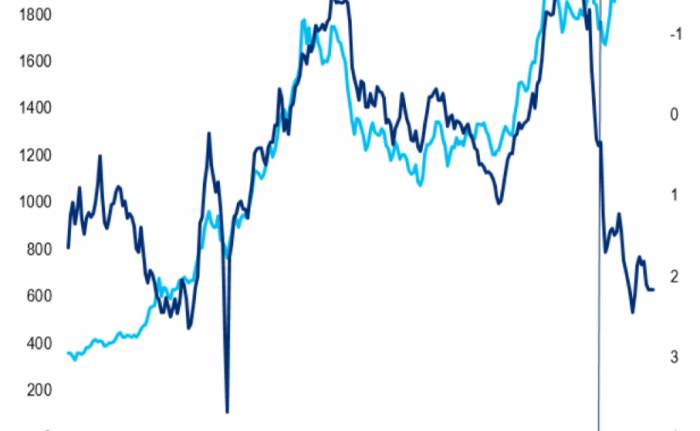

In the first quarter, despite increasing geopolitical tensions and uncertainties in the interest rate outlook, U.S. stocks continued to reach new highs as the market still expected multiple rate cuts from the Federal Reserve, and the overall demand for hedging in the U.S. stock market fell to a multi-year low. However, last Thursday, the Cboe Volatility Index (VIX), which measures the implied volatility of the S&P 500 Index over the next 30 days, closed at its highest level since November last year. Although it fell slightly on April 5, it remained above the 200-day moving average. After a bumpy week, U.S. stock traders, who have been "overly complacent" for a long time, have once again realized the necessity of hedging risks.

Joe Mazzola, head of trading at Charles Schwab, said: "Investors are beginning to realize that the reason they were able to get through the first three months of this year smoothly was because the market was always betting on the possibility of Federal Reserve rate cuts." Now, investors are starting to hedge the risks of U.S. stocks again, pushing the premium of 3-month put options over call option contracts to the highest level since mid-January. Investors have also increased their positions in tail risk hedging for the stock market, a tool often used to prevent major stock market crashes rather than just minor adjustments.

In addition, some investors have also started using put spreads, which are less costly than directly establishing put positions, but also provide less protection in a stock market downturn. Data from Susquehanna International Group shows that investors have recently started to significantly establish put spreads for the S&P 500 Index, the technology stock-focused Nasdaq 100 Index, and the Russell 2000 Index, which tracks the performance of small-cap stocks.

Stephen Solaka of Belmont Capital Group, who manages hedge strategies for wealth management companies and institutions, revealed that an increasing number of clients have recently requested the establishment of portfolio hedges against benchmark stock indices and individual technology stocks. He said that this demand is understandable, "In addition to the uncertainty of Federal Reserve policy, other factors causing investor anxiety include the upcoming first-quarter earnings season, geopolitical tensions, and the U.S. presidential election."

Rohan Reddy, Director of Research at Global X Management, told Yicai reporters, "As the market consensus continues to strengthen, even the most fearless bulls will be anxious about some unwelcome surprises. Of course, the situation could indeed become bumpy, and more hedging demand and risk aversion may emerge in the future."

U.S. bond investors also quickly responded to the shift in expectations. Last week, yields on U.S. Treasury bonds of various maturities approached the highest levels of the year, with the benchmark 10-year U.S. Treasury yield jumping to around 4.40%. Peter Tchir, Head of Macro Strategy at Academy Securities, said, "Recent economic data will definitely not give the Federal Reserve the impetus to cut rates in the short term, so U.S. Treasury yields will continue to rise. Strong data and rising oil prices may mean that the 10-year U.S. Treasury yield will further rise to 4.5% to 4.6%." In the options market, traders have also started to widely bet on 10-year U.S. Treasury yields rising to 4.5%. This yield is equivalent to the level before the U.S. bond market began a significant rebound at the end of November last year.

Corporate bond investors have also started to bet on the possibility that the Federal Reserve will disappoint investors again, leading to a surge in bearish positions in the iShares iBoxx High Yield Corporate Bond ETF (HYG). The fund is very sensitive to U.S. interest rate levels, and if the Federal Reserve does indeed slow down rate cuts, these bearish bets will pay off. Alex Kosglyadov, Managing Director of Derivatives at Nomura Securities International, said, "The only factor that can drive corporate bond volatility at the macro level is interest rates. The risk of unclear prospects for Federal Reserve rate cuts may cause the U.S. corporate bond market to decline."Guy LeBas, Chief Fixed Income Strategist at Janney Montgomery Scott, told Yicai reporters: "Strong data reinforces the possibility of a later rate cut, leading more investors to moderately bearish on bonds. These data also reduce the risk of a U.S. economic recession, causing bond investors to demand higher rates of return."

This week, the United States will sell 3-year, 10-year, and 30-year Treasury bonds. A survey of investors by BMO Capital indicates that the proportion of investors who say they need higher yields to purchase Treasury bonds has risen to 57%, compared to an average of 47% over the past six months.

Join the Discussion