In March, the overall trend of A-shares was a rise followed by a retreat. As of the close on March 29th, the Shanghai Composite Index rose by 0.86% for the month, the Shenzhen Component Index increased by 0.75%, and the ChiNext Index gained 0.62%.

Excluding the newly listed stocks from the past six months, as of the close on March 29th, the top ten rising stocks in March were led by Jin Dun Shares with a cumulative increase of 200%; followed by Ai Ai Precision Engineering with a cumulative increase of 188.33%. Seven of the rising stocks had gains exceeding 100%. Among them, Jin Dun Shares, Wan Feng Autoway, Lai Si Information, Shenzhen City Communication, Zong Heng Shares, and Shang Luo Electronics were all low-altitude economy concept stocks.

NO1. Jin Dun Shares 200.00%

As a concept stock for flying cars and low-altitude economy, Jin Dun Shares recorded a 20% daily limit up on five trading days this month, with a monthly cumulative increase of up to 200%. Jin Dun Shares stated on the interactive platform that the company mainly researches and produces high-end ventilation system equipment, with impellers being the core components of the ventilation system. The high-end intelligent ventilation system equipment produced by the company falls within the scope of new quality productive forces and new-type industrialization.

Jin Dun Shares has announced several times within the month that the electric ducted fan product for flying cars, in collaboration with Tsinghua University, is still in the research and development phase and has not yet been applied. Drones represent another high-end field, which the company has not yet entered. In addition, Jin Dun Shares also announced that Director and Deputy General Manager Chen Genrong plans to reduce his holdings by no more than 8.13 million shares, accounting for 2% of the company's total share capital, from April 18, 2024, to October 18, 2024.

NO2. Ai Ai Precision Engineering 188.33%

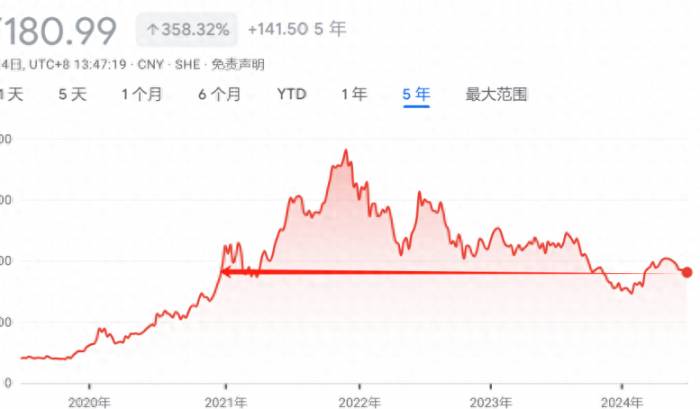

Ai Ai Precision Engineering had 14 trading days with daily limit up this month, with the stock price rising from 9.45 yuan to 33.01 yuan from March 5th to 25th. The company's announcement shows that it belongs to the traditional, non-high-tech industry and does not involve market hot concepts such as robots. The main business is the research and development, production, and sales of light conveyor belts, with products mainly used in traditional industries such as logistics. The company is still in the preliminary research and development stage for thin films used in solar cell encapsulation.

On the evening of March 25th, Ai Ai Precision Engineering issued a risk warning for stock trading, stating that the stock price increase has significantly deviated from the market and industry trends, with a clear effect of the hot potato game, indicating possible irrational speculation and the potential for a rapid decline. On March 26th, Ai Ai Precision Engineering's stock hit the daily limit down.

NO3. Wan Feng Autoway 136.03%

Wan Feng Autoway had five trading days with daily limit up this month, with the company involved in multiple hot topics such as flying cars, low-altitude economy, general aviation, and lithium batteries.Wanfeng Auto-Wing has stated on the interactive platform that the company's low-altitude fixed-wing Diamond aircraft have been delivered in batches for various applications such as private flights, flight school training, and aerial transportation. The main customers include flight schools, airlines, aviation clubs, and private consumers, primarily distributed across Europe, North America, Asia-Pacific, and the Middle East. The company is continuously strengthening its R&D in pure electric and eVTOL (electric vertical takeoff and landing) technologies to expand into a broader range of applications.

NO4, Huasheng Technology, 117.99%

Huasheng Technology has hit the daily limit of 7 trading days this month. The company has repeatedly announced that it has noticed discussions on some media platforms and stock forums about its related businesses, involving hot concepts such as low-altitude economy and parachutes. After self-inspection, the company has not been involved in businesses related to the low-altitude economy or parachutes. The company's main products are divided into two major categories: airtight materials and flexible materials, which are not related to parachute materials.

NO5, Lace Information, 113.23%

Lace Information has recorded a 20% daily limit on 3 trading days this month. According to the information, the main business of Lace Information is to provide overall solutions and a series of products for command information systems with command and control technology as the core, and has been serving the modernization of the national governance system and governance capabilities for a long time.

On the evening of March 21, Lace Information announced that it has noticed a lot of discussions recently about the company's business layout in the general aviation field. At present, the company's products in the field of civil aviation air traffic management are various types of civil aviation air traffic management systems, mainly targeting high-altitude airspace, effectively maintaining air traffic order and ensuring smooth air traffic. From 2021 to 2023, Lace Information's business revenue in the general aviation field accounted for a small proportion of the main business revenue, only 0.43%, 1.04%, and 0.24% respectively.

NO6, Shenzhen Urban Traffic, 103.09%

Shenzhen Urban Traffic has recorded a 20% daily limit on 1 trading day this month. According to the information, the company's main business focuses on the digitalization, networking, greening, and resilience of infrastructure, providing customers with world-leading digital urban traffic overall solutions and operation services.

Shenzhen Urban Traffic has repeatedly stated on the interactive platform that the company has officially undertaken the first phase of the Shenzhen low-altitude intelligent integrated infrastructure construction project in conjunction with another Shenzhen research and consulting institution. The project mainly focuses on the development of Shenzhen's low-altitude economy, constructing a software platform for an intelligent integrated system that can cover the entire city (including low-altitude operation management system and low-altitude management service system), building supporting management service centers, data centers, and drone test sites, accessing typical urban scenarios, and verifying the software platform.

NO7, Zongheng Shares, 101.58%

Zongheng Shares has increased by 101.58% this month. The company's main business is in the field of general aviation, providing a series of products and services related to low-altitude economy and air traffic management.Zongheng Shares recorded a 20% daily limit up on two trading days this month. Information shows that the main business of Zongheng Shares is the research and development, production, sales, and service of industrial drone-related products.

On the evening of March 21, Zongheng Shares issued an announcement stating that, although eVTOL products have attracted attention from the capital market, the company has not yet initiated development. As an important product direction for low-altitude economy, the market prospects and business model of eVTOL still have uncertainties. The company is currently in a loss-making state, and its future profitability will be affected by multiple factors such as company management, market demand, competitive landscape, and changes in the economic environment.

NO8, Shangluo Electronics 99.28%

Shangluo Electronics recorded a 20% daily limit up on one trading day this month. Information shows that the main business of Shangluo Electronics is to provide electronic component products for electronic product manufacturers in fields such as network communication, consumer electronics, automotive electronics, and industrial control.

On March 29, Shangluo Electronics stated on the investor interaction platform that the prototype of its staked company "Yiweit" has completed its first protected flight and will proceed to a free first flight. The product development cycle and first flight situation of eVTOL are still uncertain both domestically and internationally. In addition, Shangluo Electronics stated on the investor interaction platform that the company indirectly supplies electronic components such as resistors, capacitors, diodes, and power chips to "Xiaomi Cars" through suppliers.

The annual report released by the company on the evening of March 29 shows that in 2023, the net profit attributable to the parent company was 33.99 million yuan, a year-on-year decrease of 74.32%; operating income was 5.103 billion yuan, a year-on-year decrease of 9.53%.

NO9, RoboTech 89.86%

RoboTech recorded a 20% daily limit up on one trading day this month. On the evening of March 1, RoboTech disclosed the record of investor relations activities, showing that on February 28, 2024, the company received a reply from the Shenzhen Stock Exchange agreeing to resume the review of the acquisition transaction of ficonTEC. Currently, the company's application documents for this major asset restructuring are under normal review process at the Shenzhen Stock Exchange.

Furthermore, RoboTech stated that ficonTEC's customers include a group of world-renowned leading companies in the semiconductor, optical communication, and lidar industries, such as Intel, Cisco, Broadcom, NVIDIA, Ciena, Finisar, nLight, Lumentum, Velodyne, Infineon, Huawei, etc., and has a good customer resource advantage. As of January 31, ficonTEC had orders on hand of about 57.65 million euros, of which NVIDIA (Nvidia) orders were about 10.076 million euros.

NO10, Jinrong Tianyu 85.07%

(The information for NO10 is not provided in the original text.)Jin Rong Tian Yu, a concept stock related to Xiaomi's automotive venture, has recorded a 20% daily limit up on two trading days this month. Information shows that the main business of Jin Rong Tian Yu is the integrated high-end product manufacturing and service, including the research and development, production, assembly, and sales of precision stamping molds and precision stamping parts. The company stated on the interactive platform that it has made significant progress in the business of cold forging products, thereby securing the business of high-end cold forging parts for automotive safety components.

Jin Rong Tian Yu expressed on the interactive platform that currently, the company is accelerating the expansion of its business in the new energy vehicle market and has obtained supporting business for new energy vehicle models, including those from Xiaomi. In addition, the company has passed the audit and certification by Huafeng Fuel Cell Co., Ltd., securing a new project for aluminum die-casting of power systems for hydrogen fuel cell vehicles.

Join the Discussion