Known as the "Congressional Hill Stock God," former U.S. House Speaker Pelosi has been actively trading recently. According to records of congressional stock transactions, Pelosi purchased call options for Broadcom and 10,000 shares of NVIDIA, while selling off some Tesla and VISA stocks.

Accurately Timing the AI Boom to Make a Killing with NVIDIA

The records indicate that on June 24th, Pelosi bought 20 call options for Broadcom with a strike price of $800 and an expiration date of June 20, 2025. The total value of this transaction is estimated to be between $1,000,001 and $5,000,000. Two days later, on the 26th, Pelosi made another significant investment by purchasing 10,000 shares of NVIDIA. This transaction, similar to the Broadcom purchase, is valued between $1,000,001 and $5,000,000.

So far this year, both NVIDIA and Broadcom have seen substantial increases in their stock prices, with gains of 154% and 52% respectively, primarily benefiting from the surge in artificial intelligence-related spending.

Among these, the purchase of NVIDIA is particularly noteworthy, as Pelosi has a long and remarkable history of trading with NVIDIA, including a very successful options trade she made at the end of 2023. As early as the beginning of 2024, it was reported that Pelosi's investment returns from NVIDIA had already exceeded her annual salary as a congresswoman.

Analysts point out that if NVIDIA continues to perform well in the second half of the year, even with a gain of only half of what it was in the first half, Pelosi's newly purchased 10,000 shares could bring her a profit of about $1 million, which is more than five times her annual salary.

As for the call options for Broadcom, with a strike price of $800, there is also a significant potential for appreciation, as Wall Street generally believes that Broadcom's stock will rise by at least 11% over the next 12 months.

Selling Tesla Likely at a Loss, VISA Still a Big Profit

However, Pelosi's trading activities are not limited to stock purchases. On the same day she bought the Broadcom options, Pelosi sold 2,500 shares of Tesla, with this sale estimated to be worth between $250,001 and $500,000. Finally, on July 1st, Pelosi partially sold her shares in Visa, involving 2,000 shares, with an estimated value between $500,001 and $1,000,000.

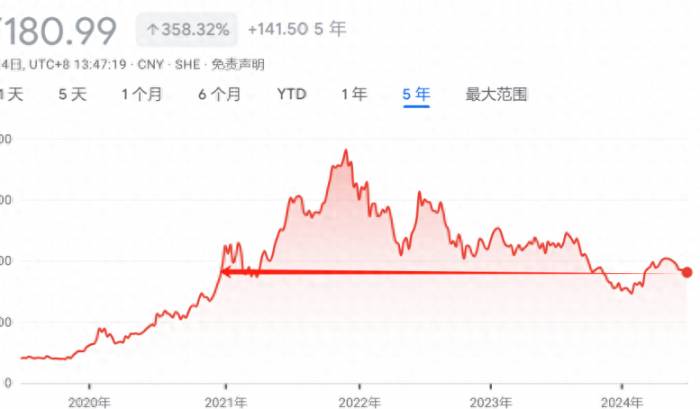

Analysis suggests that the timing of Pelosi's Tesla stock sale seems to be off. The Tesla shares sold on June 24th were likely purchased by her in March 2024. Given that Tesla's stock price fell from around $340 to $182, Pelosi lost approximately $160 per share on Tesla. Overall, the loss from this transaction is about $400,000. Moreover, just after her sale, Tesla has recently experienced a series of increases, with the stock price already back above $240, showing a difference of nearly $60 from the day of the sale to the present, totaling a difference of about $150,000.On the other hand, selling Visa shares appears to be highly profitable, as Visa's stock price was around $270 on Wednesday, while it is reported that Pelosi bought these shares at less than $30 per share as early as 2011. Among them, the sold Visa shares are listed as a partial sale, which means the couple still holds shares in the credit card company. Moreover, the Pelosis participated in Visa's IPO, purchasing 5,000 shares at the IPO price of $44 in 2008. This transaction raised suspicions at the time because the company's headquarters is located in Pelosi's hometown district.

To avoid attention, Pelosi usually reports her trades just before the U.S. Independence Day when the stock market is closed. The X account Congresstrading, which closely monitors the trades of members of Congress, stated that Pelosi's choice to report her trades just before the Independence Day holiday is to avoid media attention, but this actually makes her more predictable.

Analysts believe that Pelosi's trades are significant because her husband, Paul Pelosi, is a venture capitalist who often makes large purchases of stocks and options. Although Pelosi has repeatedly stated that she does not share stock tips or insider information with her husband, the timing of several trades has raised questions among investors. These trades provide a glimpse into Pelosi's investment strategy, showing her confidence in the technology industry. As for how these trades will affect her financial investment portfolio in the long term, it remains to be seen.

Given the interest of retail investors in congressional trades, especially in Pelosi, who is known as the "Congressional Stock Goddess," Wall Street has launched several ETFs on related themes. These include the Unusual Whales Subversive Republican Trade ETF and the Democratic Trade ETF, which track the trading activities of Republican and Democratic members of Congress, respectively.

In addition, Tuttle Capital has applied to the U.S. Securities and Exchange Commission (SEC) to launch the Capital Congressional Trade ETF, which will primarily invest in "company stocks reported by current U.S. members of Congress and/or their spouses through the publicly disclosed documents stipulated by the STOCK Act."

The ETF is expected to be launched in August 2024. As for its operation mode, it will establish the initial investment portfolio by considering each member of Congress's seniority, participation in congressional committees, and their record of creating excess returns. Subsequently, when a member of Congress reports buying or selling a stock, the ETF will correspondingly buy or sell that stock.

Join the Discussion