On Tuesday, July 2nd, the Nasdaq and the S&P 500 turned positive, while the Dow Jones maintained its downward trend.

The Nasdaq, dominated by technology stocks, opened 71 points lower but turned positive within half an hour, with the gain once expanding to nearly 0.19%. The S&P 500 opened 13 points lower, erased its losses, fluctuated multiple times in the short term, and hovered around 0% with minor oscillations; the Dow Jones, a collection of blue-chip stocks, opened 61 points lower, turned positive within half an hour after the opening, and rose more than 0.1%, but still maintained its downward trend.

The performance of star technology stocks was mixed. Tesla led the gains among the U.S. "Seven Sisters," with its increase once expanding by more than 10%. Data released at 21:00 Beijing time showed that Tesla delivered 444,000 new vehicles in Q2, exceeding the market expectation of 439,300. At the same time, Tesla deployed 9.4 GWh of energy storage products in the second quarter, which is the highest quarterly deployment to date.

Apple turned positive at the beginning of the trading day, and its gain expanded to over 1.6%, reaching a historical high of $220.34. Reports indicated that, according to supply chain sources, due to the appeal of upgrades in generative AI and other areas, Apple expects its iPhone 16 series shipments to be between 90 million and 100 million units, and has increased the order size for the A18 series of chips.

Netflix once rose by about 0.3% but fluctuated to negative multiple times; Microsoft shook off its downward trend half an hour after the opening, once rising by nearly 0.3%; Google A once fell by nearly 0.8%, then turned positive and rose by more than 0.3%; Meta fell by more than 1% at the beginning, but turned positive an hour after the opening; Amazon fell, although it once briefly rose by about 0.1%, it could not change the downward trend, once falling by more than 0.55%.

The performance of chip stocks was mixed. The Philadelphia Semiconductor Index and the industry ETF SOXX once rose by about 0.8% and 0.95% respectively at the beginning of the trading day, but dived straight down by about 0.5% half an hour after the opening; NVIDIA maintained its downward trend, rebounded slightly within half an hour after the opening, then dived to fall by about 2.6%; the NVIDIA double long ETF once fell by nearly 5%.

In terms of news, U.S. Bank clients have been flocking to exit the U.S. stock market for the second consecutive week, with hedge funds leading the capital outflow, while institutions and retail investors are net buyers. Strategists such as Jill Carey Hall stated in a report to clients on Tuesday that clients sold $3.1 billion worth of U.S. stocks in the five days ending June 28th. Hedge funds have been net sellers for three consecutive weeks, while institutional and retail clients are net buyers.

Mid and large-cap stocks have recorded capital inflows for the fourth consecutive week, while small-cap stocks have seen capital outflows for the first time in five weeks. In terms of industry, technology stocks have seen the most capital inflows, and the continuous buying time for communication services stocks is the longest, lasting 13 weeks. Non-essential consumer goods have seen the largest capital outflows. In the first half of 2024, institutional and hedge fund clients have been stock sellers so far this year, while retail capital flows have been close to neutral. Corporate client buybacks have approached the level of the entire year of 2023.

Federal Reserve Chairman Powell stated at the central bank forum hosted by the European Central Bank that the Fed has made considerable progress in inflation. However, he also indicated that he would like to see more progress before having enough confidence to start cutting interest rates.

In addition, AI concept stocks showed mixed performance, with Advanced Micro Devices (AMD) rising by more than 3.6%; popular Chinese concept stocks generally fell.Here is the translation of the provided text into English:

Before the update at 21:50 Beijing time this week, on the eve of the release of U.S. employment data, investors reduced their positions to wait and see, causing the three major U.S. stock indices to fall collectively. The Nasdaq Composite fell by 0.42% at the beginning of trading, the S&P 500 fell by 0.29%, and the Dow Jones Industrial Average fell by 0.20%.

As of the time of writing, the Dow Jones has turned positive.

Technology stocks showed mixed performance. Tesla's share price rose by over 4%, marking the sixth consecutive day of gains. In terms of news, the company's second-quarter deliveries reached 443,956 vehicles, exceeding market expectations.

Nvidia's share price fell by over 2%, with reports that the French competition authority plans to accuse Nvidia of anti-competitive behavior.

Most popular Chinese concept stocks rose. Li Auto, NIO, Beike, and Bilibili all rose by more than 1%, while XPeng Motors' share price rose by over 3%.

Novo Nordisk's share price fell by over 2.5%, and Eli Lilly's share price fell by over 1.4%. In terms of news, Biden published an article stating that some drugs from Novo Nordisk and Eli Lilly must be priced lower.

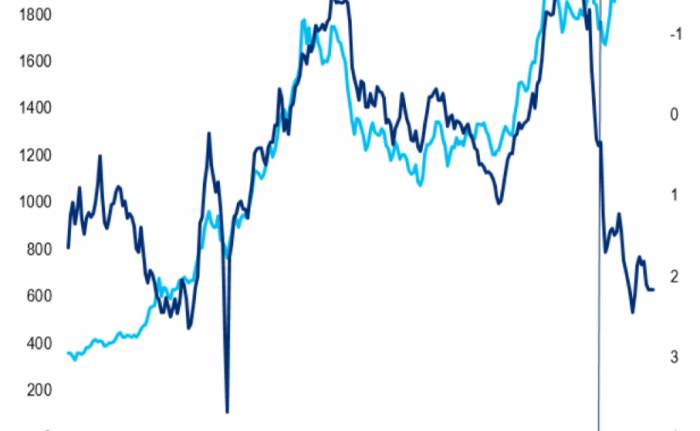

The U.S. dollar is temporarily flat, and U.S. Treasury bonds are fluctuating higher.

Last week's first round of the election debate, which was a disastrous performance for Biden, further weakened his chances of winning. The market is concerned that if Trump is elected president, it will lead to an expansion of the U.S. fiscal deficit and higher inflation, thereby pushing up the U.S. dollar and U.S. Treasury bond yields.

As of the time of writing, the U.S. Dollar Index is flat at 105.83%.The 10-year U.S. Treasury bond rally has temporarily paused, falling by more than 1% during the day, to 4.425%.

Crude oil continues to hold high, while gold prices continue to decline.

Brent and U.S. crude oil continue to rise, maintaining levels at a two-week high.

Spot gold fell by more than $4 during the day, to $2,327.43 per ounce.

Join the Discussion