On July 25th, the international gold price significantly declined overnight, breaking below $2400 per ounce (London Gold). Gold mining stocks exhibited even weaker performances, with leading stock Zhaojin Mining (01818.HK) plummeting nearly 10%, and Zijin Mining (601899.SH) and Shandong Gold (600547.SH) both experiencing declines exceeding 5%.

Previously, gold mining stocks had released half-year performance forecasts indicating substantial growth, but this did not significantly boost their performance. Instead, they underwent a sharp correction for over a week. Some industry insiders believe that the previous rise in gold mining stocks may have overreacted to the gold price, making them more sensitive during the correction. Even if the gold price stabilizes later, it is estimated that the chances for gold mining stocks to perform well are not high, and a breakthrough increase would require gold to outperform expectations.

The leading stock has corrected by more than 20% cumulatively.

On July 17th, at the opening, gold mining stocks such as Zhaojin Mining (01818.HK) once again challenged new highs, with individual stocks like Shandong Gold and Zijin Mining also rising. However, to date, Shandong Gold and Zijin Mining have still not been able to break through the previous high point of May 20th. Subsequently, they fell for seven consecutive trading days, with the leading stock Zhaojin Mining's cumulative adjustment from the high point on July 17th exceeding 20%.

Cen Zhiyong, an analyst at Wutong Research Institute, told reporters from First Financial that one of the reasons for the decline in gold mining stocks is the correction in the gold price, which has led to a correction in gold mining stocks. Additionally, the collective adjustment of state-owned enterprise stocks that had previously risen significantly has also had an impact on gold mining stocks.

Regarding the recent correction in gold, Wang Xiang, fund manager of Bosera Fund's Gold ETF (159937), stated that previously, as Federal Reserve officials hinted that a rate cut was a step closer, the decline in U.S. Treasury yields and the U.S. dollar index made precious metals strong, and the gold price set a historical record. However, subsequently, some U.S. economic data remained resilient, the European Central Bank decided to maintain its stance, macro-political factors disturbed the market, and long-positioned capital took profits at high levels, causing precious metals to continue to correct after reaching a peak. Amid the booming gold price, both Trump and the International Monetary Fund made statements suggesting that the Federal Reserve should not cut rates within the year, leading to some profit-taking in the gold market, which had been continuously increasing its bets based on the expectation of easing.

Looking at the half-year performance forecasts, Zijin Mining estimates that it will achieve a net profit attributable to the parent company of approximately 14.55 billion to 15.45 billion yuan in the first half of 2024, an increase of about 41% to 50% compared to the same period last year, mainly due to the simultaneous increase in the quantity and price of gold, copper, and silver. Shandong Gold's performance forecast shows that it expects to achieve a net profit of 1.25 billion to 1.45 billion yuan in the first half of the year, an increase of 42.07% to 64.81% year-on-year, with the continuous rise in gold prices and the acquisition of Yintai Gold providing momentum for profit growth.

On July 17th, gold set a historical record high of $2483 per ounce (London Gold), but neither Zijin Mining nor Shandong Gold broke through the high point of May 20th. Shandong Gold even showed a pattern of three peaks on April 12th, May 20th, and July 17th, with each peak lower than the previous one.

In the first half of the year, there were also significant financing activities by gold mining stocks listed in Hong Kong: On April 15, 2024, Zhaojin Mining, which doubled its stock price in two months, announced a placement of 130 million shares, equivalent to about 3.9% and 4.8% of the expanded issued share capital and H-share total, respectively, with a placement price of HKD 13.2 per share, raising a total of HKD 1.74 billion; On April 17th, Lingbao Gold (03330.HK) placed 26.9168 million shares, equivalent to about 3.98% of the expanded issued H-share number and about 2.16% of the issued share number, with a placement price of HKD 3.02 per share.

Future Market: Should You Buy Gold or Gold Mining Stocks?Some industry insiders believe that gold still has multiple factors supporting it in the medium to long term, especially benefiting from global central bank interest rate cuts and the reduction of returns in other asset classes. However, gold mining stocks have already reached an emotional peak and may reflect an overly optimistic view of gold prices. To break through the previous highs, gold prices need to perform beyond expectations.

Dongwu Securities analyst Meng Xiangwen stated that with the Federal Reserve signaling interest rate cuts, gold is in a major upcycle: U.S. inflation has effectively declined but retains resilience, with CPI having significantly dropped from high levels, yet finding it difficult to quickly break through the 3% threshold. On the economic front, high interest rates have suppressed demand in the real economy, and the yield on U.S. long-term and short-term bonds has shown a long-term inversion. The decline in real interest rates during the interest rate cut cycle is expected to further boost the rise in gold prices.

The World Gold Council's "2024 Global Gold Market Mid-Year Outlook" indicates that the growth momentum for gold is likely to come from interest rate cuts in developed economies, which is expected to attract Western investors into the gold market. Moreover, under the tense geopolitical situation, the global stock market is thriving, and it seems that the bubble is about to burst. Global investors will start seeking risk-hedging measures, providing continuous support for the gold market. Of course, the outlook for gold is not entirely bright. If central bank gold purchases decline significantly, or if a large number of Asian investors take profits, it could hurt gold's performance. However, given the current situation, gold will continue to play an important role in a robust asset allocation strategy, benefiting global investors.

An analyst from Hong Kong told reporters from First Financial that for the previously overheated U.S. economy, whether it's a soft or hard landing, gold benefits. As other asset returns gradually decrease and global central bank interest rate cuts continue, these are all favorable for gold, and gold remains promising in the medium to long term. However, gold mining stocks are a different case. After some stocks have doubled within the year, some have actively raised funds, and their valuations are not low. If they continue to rise and break new highs, gold needs to perform beyond expectations. Moreover, gold mining stocks also face the risk of not meeting the expected integration progress of their own merger and acquisition mining projects.

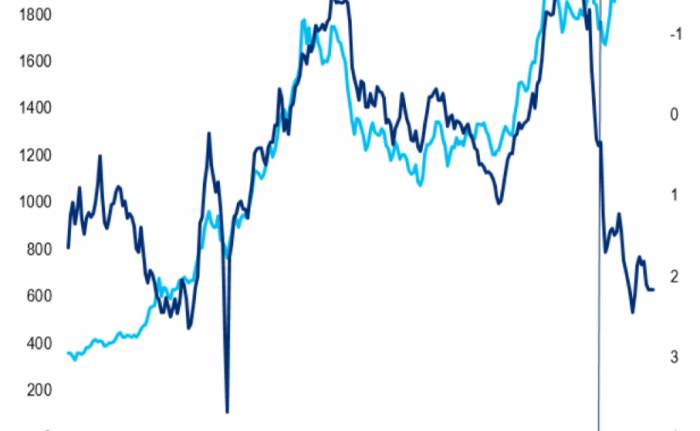

Starting from the second half of 2010, during the inflation period, the rise in gold prices was accompanied by a strong performance of gold mining stocks. Among them, Zhaojin Mining (01818.HK) peaked on April 26, 2011, Zijin Mining and Shandong Gold both peaked on November 5, 2010; the peak time for gold itself was later, with Shanghai gold futures peaking at 398 yuan per gram (international gold prices breaking through $1,900 per ounce) on August 23, 2011.

Join the Discussion