On April 5th local time, the U.S. Bureau of Labor Statistics released the latest data showing that the non-farm employment population increased by 303,000 in March, far exceeding the expected 200,000, while the previous value was revised down to 270,000. Over the past 12 months, the average monthly net increase in employment was 231,000.

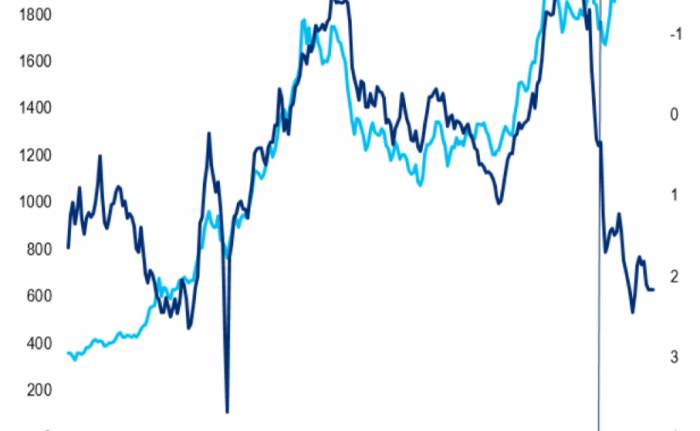

The data indicated that the U.S. unemployment rate remained unchanged at 3.8%, in line with expectations; one of the key indicators affecting inflation trends, the wage level, saw a year-on-year increase of 4.1% in March, with a month-on-month increase of 0.3%, and the labor force participation rate rose by 0.2 percentage points to 62.7%.

Ian Lyngen, Head of U.S. Rate Strategy at BMO, told Yicai Global that the March non-farm report highlighted the resilience of the job market, continuing to provide ample flexibility for monetary policy, allowing the Federal Reserve to maintain higher interest rates for a longer period. "The job market remains resilient, coupled with the rebound in the core Consumer Price Index (CPI), which will greatly reduce the possibility of a rate cut in June, and this expectation will extend into July," Lyngen said.

Some analysts believe that investors are in a dilemma, on one hand, they hope for a strong economy to support further growth in corporate profits, and on the other hand, they hope for a weak labor market to give the Federal Reserve the green light to start cutting interest rates. U.S. stocks edged higher before the market opened, with Dow and S&P 500 futures up 0.2%, and Nasdaq futures up 0.3%.

The healthcare industry saw strong employment growth.

Looking at the industry breakdown, healthcare, government, and construction sectors achieved employment growth last month. Specifically, the healthcare industry hired an additional 72,000 people, with an average of 60,000 jobs created per month over the past 12 months; the U.S. government sector added a net of 71,000 jobs in March; the construction industry added 39,000 new jobs during the same period; the leisure and hospitality industry, which has led employment growth for most of the post-pandemic period, added 49,000 jobs last month and has returned to pre-pandemic levels, with an average of 37,000 new jobs added per month over the past 12 months.

It is worth mentioning that in recent non-farm reports, strong initial data is often revised down in the following month.

The Chief Investment Office (CIO) of UBS Wealth Management, in a report sent to Yicai Global, predicted that the hiring boom should start to slow down soon, and the gradual increase in unemployment rates in more regions also indicates that future employment growth may slow down. The institution's base scenario is still that the U.S. economy will have a soft landing, with more moderate growth, and it is expected that the Federal Reserve will have the basic conditions for a rate cut at the June meeting, with inflation eventually approaching the Federal Reserve's 2% target.

Federal Reserve officials "hawkish stance"

The Federal Reserve reiterated its forecast of three rate cuts this year at the March interest rate meeting. However, signs of a strengthening economy have led investors to question whether this scenario will occur, especially as many Fed officials have recently made hawkish speeches, expressing concern about the unexpectedly stubborn inflation so far this year.The day before, Neel Kashkari, President of the Minneapolis Federal Reserve, stated: "If inflation continues to head towards the 2% target, I expect two rate cuts this year; however, if the inflation trend remains stagnant, I will question whether the Federal Reserve needs to cut rates." On the same day, Tom Barkin, President of the Richmond Federal Reserve, expressed that no one wants inflation to re-emerge, and that a measured approach to policy would be wise. He primarily focuses on the price trends in goods and services, believing that before feeling comfortable with a rate cut, there needs to be a broad slowdown in the pace of price increases.

On the 3rd, Federal Reserve Chairman Jerome Powell said that higher-than-expected inflation in January and February has not shaken the Federal Reserve's view that, despite some bumps, the rise in prices will continue to slow down. He further indicated that there are signs that the labor market conditions are not as tight as they have been in recent years, which alleviates concerns about wages and prices potentially rising in tandem.

As of the time of the reporter's submission, traders are betting that the probability of the Federal Reserve standing pat in May is 93.5%, with only a 6.5% chance of a 25 basis point rate cut to a range of 5.00% to 5.25%; the likelihood of maintaining the current rate in June is 43.3%, with a 56.7% chance of a rate cut.

Join the Discussion