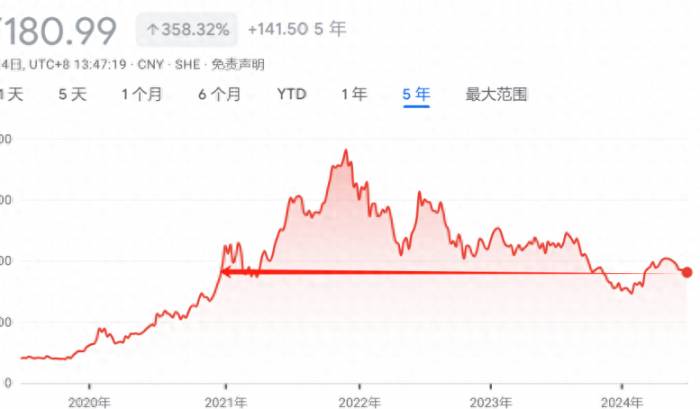

After a dramatic rebound to 3000 points, the A-share market seems to have reached an awkward position. For investors, it's like being suddenly fished out of the water and thrown onto the shore at 3000 points, which is not only awkward but also confusing. Watching the index rebound by nearly 20%, with some stocks in the national team's basket surging over 50%, yet their own portfolios are still in the red. This rebound has only stopped the bleeding for most investors, far from healing the wounds. There is a significant divergence between the overall market and individual stocks. In this rebound, it's not about how much one has earned, but rather how much less one has lost. However, no matter what, with the national team working so hard to stabilize the market, it's difficult to blame the overall environment for the grievances. At the same 3000 points, the losses and gains of investors are not symmetrical after it was not conquered and after it was rescued. At this position, whether to cut losses and exit or to add positions and wait for a new rebound, most investors seem to be "looking around in confusion" on the desolate ruins after the war, lying flat like the market's pattern.

The night before the market's dramatic rebound (January 29th), I turned bullish, pointing out that as the national team gradually drives popularity, "I believe that the economy will steadily recover in 2024, and the stock market will also usher in a real valuation repair." Subsequently, in the article, I suggested that after passing 3000 points, whether the market can continue to rise depends on whether the market's internal bullish momentum can take over the baton from the national team. Just like the three-stage propulsion of a rocket, now it's time for the first stage (national team) to end, and the second stage to continue. Although I clearly stated again that "the risk of going long is obviously smaller than that of going short," what I worry about is whether the market has enough internal momentum:

First, it takes more than one day to freeze three feet of ice. We have just experienced the longest and most miserable losing effect in the history of A-shares, and investors are still wary, with lingering fears. It will take some time for confidence to heal. In the case of earning the index but not the money, it is still difficult for investors to increase their risk appetite.

Second, there is a lack of funds to continue to go long. In a contracting environment, investors are using money to repair the balance sheet damage caused by falling housing prices, coupled with a significant drop in wage income due to pay cuts and unemployment. Even if three consecutive positive days change the three views, most investors are still hesitant to buy.

Third, institutional investors have experienced too much window guidance, and under the expectation of restrictions on selling, they are also correspondingly cautious about buying - what if they buy now and are restricted from selling later? How to manage liquidity when clients request redemption? Now, the regulatory authorities also emphasize the protection of the rights and interests of financial investors. Some policies themselves are contradictory.

Fourth, the performance of listed companies last year is likely to be lower than expected, and the impact of the black annual report is imminent. From various indicators, it is difficult for the performance of listed companies to improve significantly, which is an inevitable micro reaction in a deflationary environment. Of course, the performance of manufacturing enterprises that can operate globally should be good, and most listed companies should be in poor operation, needing value reassessment to cater to the fundamentals.

Fifth, global geopolitical tensions are increasing. Looking at the spillover impact of past external risks, it seems that every major event requires A-shares to pay the bill.

Although the upward momentum of A-shares faces many obstacles, it is by no means easy to fall sharply. Why? It's still the savior national team. In fact, we have seen that the decision-making layer, which has always maintained strategic determination, has changed its style of action dramatically after the huge shock in A-shares, and is willing to do everything to stabilize the A-share market. The stock market stabilization has a "supreme sword," which can be well fulfilled without blame. This can be said to clear the psychological barriers of responsibility for rescue operations with great technical difficulty. On the contrary, if the stock market falls sharply again, it will be held accountable. Moreover, under the supreme sword of political correctness, the rescue funds can also be said to be extremely sufficient.

In this way, the national team has given A-share investors a free put option, a "safety margin" of policy protection. No matter what the individual stocks are, the index representing the stability indicator will definitely not fall sharply again - it has been very difficult to spend more than 500 billion yuan to rescue the shore, how can it be tolerated to be washed away again.However, the central bank can only print base money. To form broad money that constitutes the real economy, a money multiplier and credit creation are needed, which requires the joint action of bankers and entrepreneurs to allow financial services to serve the real economy. If the money used by the national team to purchase stock ETFs is merely to rescue valuations, the improvement of EPS still requires further repair of the economic fundamentals. Therefore, the overall logic is to trade space for time, using the space of 3000-3200 points to exchange for the time of economic recovery. After all, compared to the fleeting ups and downs of the stock market, the recovery of the real economy is relatively slow. Stabilize valuations, and then wait for the performance of listed companies to go up, leaving time for the brewing of the "second-stage rocket" power. The general action route is that the stabilization fund formed by base money stabilizes the stock market, and the broad money injected into the entity stabilizes the economy, with the two supporting each other to form a positive interaction to promote valuations to rise.

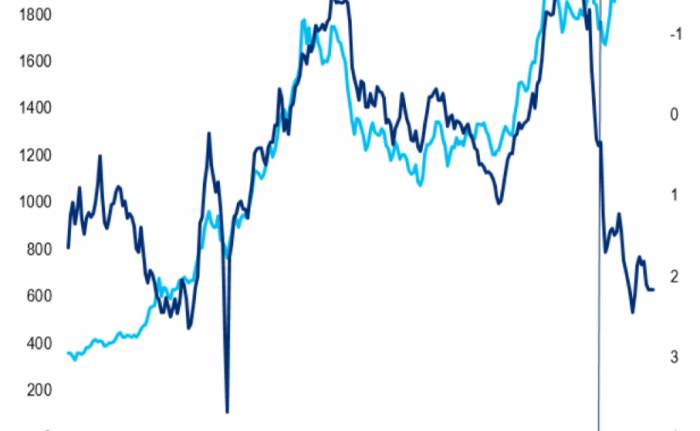

We have seen that various economic data began to improve significantly in February, with exports leading the way, once again creating a situation where the external cycle drives the internal cycle. Driven by exports, the profits of manufacturing enterprises also performed strongly. The PMI index, which represents the degree of economic prosperity, has once again returned to the expansion area. Why did the unexpected warming occur? I personally think it is still driven by the global economy - the whole world is experiencing inflation, and prices are rising everywhere, but only China's prices remain stable. This divergence has once again highlighted the cost advantage of Chinese manufacturing, and the global trade structure must be rebalanced. The result of the rebalance is an increase in China's net exports and further improvement in the balance of payments surplus. Therefore, we see that cyclical stocks in the A-share market have begun to rebound strongly, and the probability of the market breaking through 3100 points has also increased.

However, the fundamental problem is still structural, such as the imbalance in the financing and investment functions of the stock market. For a long time, the financing service function has been greater than the investment function, and the public lacks a sense of gain. For example, there are structural issues in money creation. Looking at the total amount, the market is not short of money. The broad money has already broken through the 300 trillion threshold and has entered an exponential acceleration area, that is: the first hundred trillion, it took thirty years from the beginning of the market economy. The second hundred trillion, it only took eight years. The third hundred trillion, it only took a short four years! This indicates that society is not short of money, but confidence and smooth channels for savings to be transformed into investments are lacking.

These structural issues mean that as long as the financing and investment relationship in the stock market, the relationship between dead money and live money in money, and the relationship between savings and investment in the macro are straightened out, many problems of stock market valuation repair and economic recovery will be solved. However, structural issues must be addressed with structural reform measures. As long as there is a determination to solve the stubborn diseases of legalization and marketization in the stock market, to let market entities and regulatory authorities follow the rules, to eliminate the behavior of major shareholders infringing on the interests of minor shareholders, and to eliminate the additional uncertainty caused by direct administrative intervention by regulatory authorities, such as restrictions on selling, which leads to investors not daring to buy, the healthy development of China's stock market will definitely not be a problem, and building a financial powerhouse will become possible.

Join the Discussion