On April 2nd, the three major A-share indices showed mixed performance in the morning. By the midday closing, the Shanghai Composite Index rose by 0.03%, the Shenzhen Component Index fell by 0.37%, and the ChiNext Index fell by 0.21%. Titanium dioxide, oil and gas, and steel sectors led the gains, while the lithium battery and low-altitude economy industry chains were active again; multimodal AI topics experienced a broad correction, with Sora and Kimi concepts leading the decline.

Let's review the market hotspots from the morning session.

**Titanium Dioxide Concept Soars Rapidly During the Session, with Jinpu Titanium and Tianyuan Shares Hitting the Daily Limit Up**

The titanium dioxide concept saw a strong surge during the session. By the midday closing, Jinpu Titanium and Tianyuan Shares hit the daily limit up, Huiyun Titanium increased by over 8%, Annada rose by nearly 6%, and several other stocks rose to varying degrees.

Today, Annada's official website released an announcement stating that in the first quarter, the company's titanium dioxide production set a new record high for the year, increasing by 13.64% year-on-year, and improved by 1.65% compared to the best historical performance in the first quarter of 2022. All consumptions were stable, and titanium dioxide sales increased by 2.6% year-on-year.

Previously, Lu Bei Chemical released an announcement stating that its wholly-owned subsidiary, Shandong Xianghai Titanium Resources Technology Co., Ltd., plans to invest 719 million yuan in the construction of a 60,000-tonne annual expansion project for chloride process titanium dioxide. The announcement shows that the construction period for Xianghai Technology's 60,000-tonne annual expansion project for chloride process titanium dioxide is 24 months, with a pre-tax investment payback period of 5.62 years.

A research report from Minsheng Securities indicates that in recent years, domestic titanium dioxide capacity has expanded rapidly. Amidst the continued high prices of titanium ore and energy, overseas giants have accelerated their exit from the titanium dioxide market, and domestic product exports are entering a golden development period. In 2023, the titanium dioxide industry has seen frequent price increase letters, coupled with the exit of overseas manufacturers, which has boosted industry confidence. In 2024, the focus should be on the realization of the domestic paint industry's repair pace and the continuous growth expectation of exports overseas.

**Low-Altitude Economy Policies Emerge Densely, and Related Concept Stocks Become Active Again**

Low-altitude economy concept stocks have been active repeatedly. By the midday closing, Jianxin Shares, Changyuan Donggu, Zongshen Power, and 5 other stocks hit the daily limit up, with Shandong Mining Machinery, Guanglian Aviation, and several other stocks following suit.

CITIC Construction Investment pointed out that low-altitude economy policies are emerging densely, and for the first time, the country has clearly given two important time-point plans, proposing a trillion-yuan market size outlook. Specifically, the country and relevant industry authorities will subsequently increase the construction of infrastructure and management support systems through pilot programs and financial subsidies, and promote the issuance of aircraft airworthiness certificates. As an important part of the upstream of the low-altitude economy industry chain, air traffic control service stations are expected to usher in good development opportunities. It is recommended to focus on: 1) the construction of low-altitude air traffic control systems and platforms, with a focus on companies participating in the construction of national pilot provinces and demonstration zones; 2) the construction of aviation information systems, mainly including airport and airline management systems; 3) geographic information companies, with remote sensing and surveying capabilities, capable of converging and analyzing spatiotemporal data, applying Beidou and other technical supports to ensure the safe and stable operation of air traffic control systems, and it is recommended to focus on related targets.**Two Departments: Continuously Track the Progress of Incremental Power Distribution Projects to Promote the Quick Implementation and Effectiveness of Pilot Projects**

According to the National Development and Reform Commission and the National Energy Administration, in order to standardize the division of distribution areas for incremental power distribution services and to actively and prudently promote the reform of incremental power distribution services, the National Development and Reform Commission and the National Energy Administration have revised the "Implementation Measures for the Division of Distribution Areas in Incremental Power Distribution Business".

The main revisions include the following aspects: First, it is clarified that the provincial energy authorities are responsible for the division of distribution areas within their province, and the local offices of the National Energy Administration are responsible for issuing power business licenses (supply category) to the owners of incremental power distribution business projects. Second, it is clarified that the division of distribution areas should adhere to the basic principles of fairness, justice, safety and reliability, economic rationality, clear boundaries, and clear responsibilities to ensure the safe and stable development of the power grid; distribution areas should be divided according to the geographical scope determined by the overall planning of administrative regions or development zones, industrial parks, etc., with clear boundaries, and efforts should be made to maintain the integrity and continuity of the distribution areas to avoid repeated construction, cross-supply, and other situations that affect the implementation of universal services and basic supply services. Third, it is clarified that the division of distribution areas should be determined before the owner of the project is determined, which is convenient for potential investors to make decisions and avoid subsequent disputes; the competent department for the division of distribution areas should organize the compilation of the division plan and solicit opinions and suggestions from relevant stakeholders such as local governments, power grid companies, and potential investors. Fourth, it is clarified that the opinions on the division of distribution areas are the main basis for incremental power distribution companies to apply for power business licenses (supply category), and the autonomous agreement on division among companies is no longer a prerequisite.

Next, the National Development and Reform Commission and the National Energy Administration will guide local government departments and power grid companies (including incremental power distribution companies) to do a good job in dividing the distribution areas of incremental power distribution business; guide the local offices of the National Energy Administration to do a good job in issuing power business licenses, and help incremental power distribution companies that meet the conditions to obtain a legal business status as soon as possible. At the same time, we will closely monitor the implementation of the "Measures", fully listen to the opinions and suggestions of all parties involved in the reform, continuously track the progress of incremental power distribution projects, and promote the quick implementation and effectiveness of pilot projects.

**Deputy Minister of the Ministry of Industry and Information Technology, Dan Zhongde: Accelerate the Digital Transformation of Manufacturing and Large-Scale Equipment Updates**

According to the China Securities Journal, at the 2024 CCID Forum, Dan Zhongde, a member of the Party Group and Deputy Minister of the Ministry of Industry and Information Technology, said that combining the construction of a manufacturing powerhouse with the development of the digital economy and industrial informatization, implementing high-quality development actions for key industrial chains in manufacturing, accelerating the digital transformation of manufacturing and large-scale equipment updates, and promoting the upgrading of traditional industries, the growth of emerging industries, and the cultivation of future industries in a coordinated manner, will consolidate the leading position of traditional industries and accelerate the construction of a new batch of growth engines such as new generation information technology, artificial intelligence, new materials, and high-end equipment. It will promote the deep integration of digital technology with manufacturing technology and the digital economy with the real economy, and vigorously promote the industrialization of the digital industry and the digital transformation of manufacturing, focusing on improving the high-end, intelligent, and green development level of manufacturing.

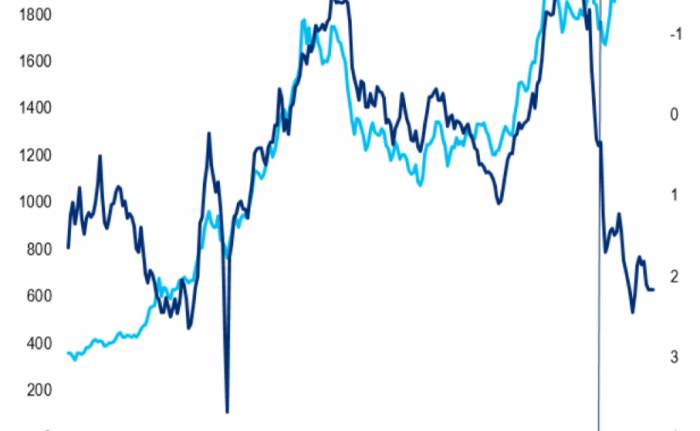

**Mid-term Association: The National Futures Trading Market Transaction Volume in March Decreased by 13.56% Year-on-Year**

The latest statistical data from the China Futures Association shows that, calculated on a single-sided basis, the transaction volume of the national futures trading market in March was 626,197,360 lots, with a turnover of 496,733.54 billion yuan, a year-on-year decrease of 13.56% and 0.46% respectively. From January to March, the cumulative transaction volume of the national futures market was 1,509,989,198 lots, with a cumulative turnover of 1,241,638.72 billion yuan, a year-on-year decrease of 9.22% and an increase of 2.70% respectively.

**Xiaomi SU7 Lock-in Orders Reach 40,000 Vehicles, with the Longest Waiting Time for Delivery Nearly 8 Months**

First Financial Journalist exclusively learned that as of the early morning of April 2, the lock-in order volume for Xiaomi SU7 has reached 40,000 vehicles. In addition, the delivery cycle of the vehicle has been further extended. On March 31, after the standard version of Xiaomi SU7 was locked in, the delivery cycle was expected to be 16-19 weeks, the Pro version was expected to be delivered in 17-20 weeks, and the Max version required 26-29 weeks for delivery. By the morning of April 2, the above delivery cycles had been extended to 20-23 weeks, 19-22 weeks, and 28-31 weeks respectively.Insiders have revealed that Xiaomi's original production plan for its cars in April was approximately 5,000 units. Currently, Xiaomi is in negotiations with suppliers to increase production capacity. However, it is estimated that there will be a process for the ramp-up of production capacity. In response to a question from a netizen, Xiaomi's car division stated that they are fully committed to enhancing production capacity and accelerating deliveries.

Join the Discussion