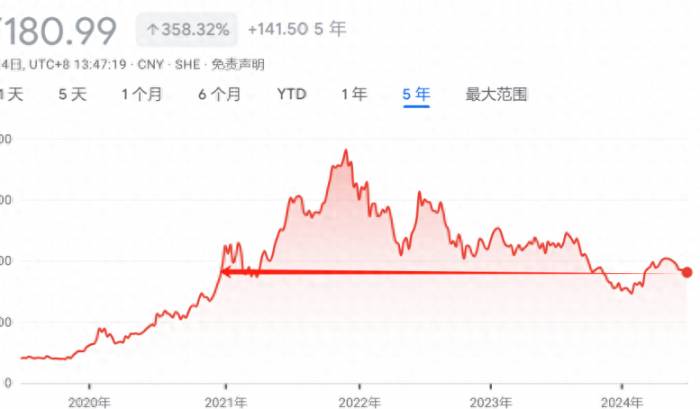

The king of global power batteries, Contemporary Amperex Technology Co., Limited (CATL), has recently seen its stock price plummet, drawing widespread market attention. Investors have been voicing their concerns on investment communication platforms, with some lamenting, "CATL's stock price is almost back to 2020 levels." According to media statistics, CATL's latest market value has evaporated by over 800 billion yuan compared to its historical peak.

In response to the persistent decline in stock price, CATL has actively taken measures to repurchase shares. On the evening of July 1st, the company issued a progress announcement on share repurchases, showing that it has repurchased 2.8742 million shares at a cost of 549 million yuan, becoming a leader in share buybacks among A-share listed companies. Since October 30th last year, CATL has cumulatively invested 2.446 billion yuan in share repurchases for future implementation of equity incentive plans or employee stock ownership plans.

However, large-scale repurchases do not seem to have immediately boosted market confidence. Over the past year, CATL's stock price has plummeted by more than 21%.

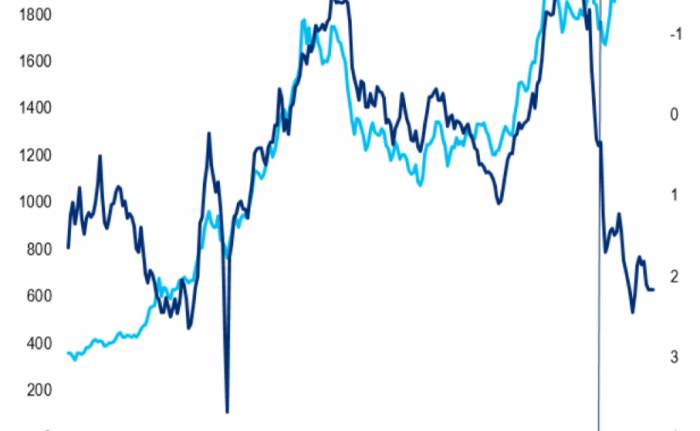

As market sentiment hit a low, Wall Street giant Morgan Stanley stepped in to defend CATL, calling it a "true high dividend" stock in the A-share market, with a 3% dividend yield that should support its stock price. Morgan Stanley analysts Jack Lu and Kaylee Xu released a research report on Wednesday stating:

Against the backdrop of the current low yield on China's 10-year government bonds, a dividend yield of over 3% in the A-share market is considered high-yielding.

Morgan Stanley's analysis points out that although geopolitical factors pose certain risks to CATL's growth prospects, the company's risk of maintaining profitability is lower compared to other high-yield stocks in the A-share market.

Although CATL has not yet announced a long-term dividend policy, its strong free cash flow allows it to maintain or even increase the current dividend amid a slowdown in the capital expenditure cycle.

Morgan Stanley also maintains its "overweight" rating on CATL, with a target price of 230 yuan per share, which is about 50 yuan higher than the current stock price.

Morgan Stanley: Long-term optimism for "CATL"

The market believes that the long-term no-risk level of profitability is crucial and considers the sustainability of dividends and the generation of free cash flow as key to investing in high-yield stocks in industries such as energy, telecommunications, and utilities.Morgan Stanley has stated that compared to energy stocks, the growth in demand for electric vehicles should far exceed that of oil, and the profit margins of oil companies are more volatile than those of Contemporary Amperex Technology Co., Limited (CATL). In comparison to utilities (hydroelectric and nuclear power), CATL boasts a healthier balance sheet, which allows it to increase dividends through strong free cash flow generation while slowing down the capital expenditure cycle, improving capital efficiency, and experiencing long-term structural sales growth.

Furthermore, CATL is transitioning from being a mere battery manufacturer to a comprehensive energy solution provider, benefiting from deep cooperation with vehicle manufacturers and product diversification (CTP3.0, CTC, and supercharging). The company is expected to maintain stable unit profit margins and return on equity.

Morgan Stanley also emphasizes that continuous upgrades in battery technology will drive the global electrification process, providing strong support for CATL's long-term development. Through product innovation, the company is expected to maintain or improve profit margins, further consolidating its market position.

Morgan Stanley forecasts that CATL's earnings per share will increase from 8.11 yuan in 2023 to 8.98 yuan in 2024, with earnings per share for 2025 and 2026 projected to be 10.4 yuan and 13.03 yuan, respectively.

Join the Discussion