As one of the key metals in battery manufacturing, cobalt has recently shown signs of "smart money" quietly returning to the market and becoming cautiously optimistic amidst low battery prices.

Recently, it has come to light that two hedge funds, Anchorage Capital Advisors and Squarepoint Capital LLP, are quietly buying physical cobalt. Squarepoint has been purchasing cobalt metal from traders, while Anchorage has been acquiring both cobalt metal and cobalt hydroxide, the latter being an intermediate product used in the production of cobalt sulfate, which is utilized in electric vehicle batteries. Anchorage has been actively trading in the CME market.

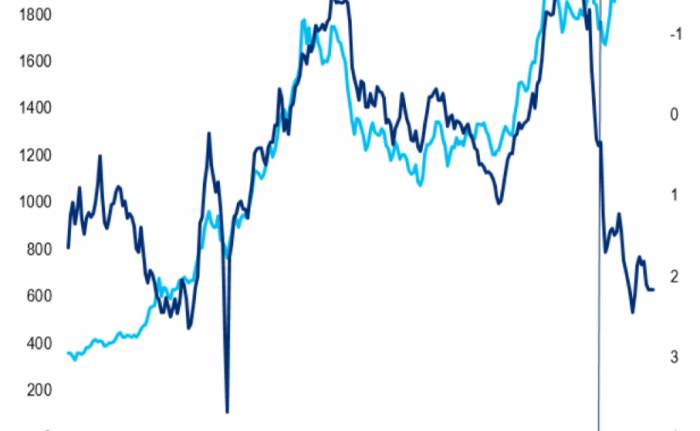

The hedge funds' move to acquire physical cobalt coincides with a period of low cobalt prices. Due to a surge in production from the Democratic Republic of Congo and Indonesia, the main suppliers of cobalt, the spot price of cobalt has fallen to its lowest in over seven years, with prices mostly ranging between $12.50 and $15 per pound this year, a drop of at least more than 60% from the peak price of around $40 per pound during the electric vehicle boom in 2022.

Commentators believe that, given cobalt's key role in transitioning to clean energy and achieving net-zero emissions, the market for cobalt may soon return to a balance of supply and demand, even in the face of oversupply estimates and declining demand for electric vehicles.

The media has pointed out that the actions of the aforementioned hedge funds are the latest signs of financial institutions participating in physical metal trading. Since the beginning of this year, a significant amount of capital has flowed back into commodities, creating opportunities for these funds to profit from the low spot prices in some previously over-supplied metal markets. Compared to commodities like copper or oil, cobalt is a relatively small and niche market. A decade ago, funds like Pala Investments took advantage of weak cobalt prices to buy in bulk, betting on the emerging energy transition and reaping substantial profits.

Unlike in the past, when the futures market had poor liquidity and bullish bets on cobalt could almost only be made by buying physical cobalt, cobalt futures have now emerged in the Comex market under CEM, creating a way for traders to hedge their physical positions in the futures market. The price of cobalt futures for delivery in one year is already 20% higher than the spot price. The significant discount on spot prices creates arbitrage opportunities; if the spot price soars, owners of physical cobalt can sell cobalt for substantial profits, and even if the spot price remains unchanged, they can lock in returns by selling futures. However, this arbitrage also carries risks, as funds holding cobalt must find buyers in the relatively illiquid physical market when they close their positions, and the cobalt market is currently severely over-supplied.

The media reports that a surge in supply and weaker-than-expected sales in the electric vehicle industry have led to a record supply surplus in the cobalt market this year, with many in the industry pessimistic about the prospects of a cobalt price rebound. The increasing popularity of lithium iron phosphate batteries, which do not contain cobalt, also poses a threat to cobalt demand. However, China's strategic reserves agency has been absorbing excess cobalt metal inventories at record levels this year, "highlighting the strategic value of this metal in the electric vehicle and defense sectors."

Observing the ETF that tracks companies mining lithium, nickel, or cobalt and generates positive income and value, the ProShares S&P Global Core Battery Metals ETF (ION), it can be seen that the fund has been fluctuating sideways since reaching its peak in 2022.

CarbonCredits, a platform serving clean energy and emission reduction-related investments and corporate activities, noted in April that while the bottom of cobalt prices is uncertain, some analysts expect prices to gradually improve in the coming quarters.

A recent report from the International Energy Agency (IEA) estimates that, given cobalt's key role in achieving global net-zero emission targets over the next few decades, the value of cobalt will grow sevenfold by 2030 and tenfold by 2050, with the market reaching over $400 billion.

Join the Discussion