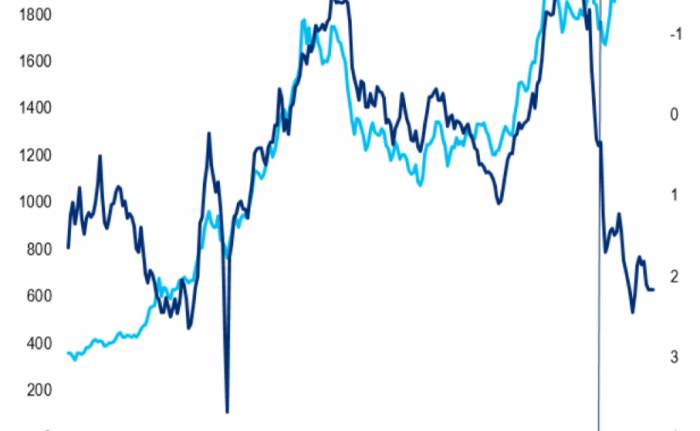

Analyst Pierre Ferragu believes NVIDIA's valuation is a cause for concern.

On Friday, July 5th, Eastern Time, Pierre Ferragu, an analyst at New Street Research, issued a warning on NVIDIA's stock. He downgraded the stock rating to "neutral," suggesting that NVIDIA's stock has limited upside potential unless in a bull market scenario.

In his report, he wrote:

"We are downgrading the stock to neutral today because there is only upside potential in a bull case, that is, a significant improvement in the outlook beyond 2025, which we are currently not convinced will materialize."

He also mentioned that revenue models indicate NVIDIA's growth rate will slow to a moderate level, with graphics processing unit (GPU) revenue expected to grow by only 35% next year.

Based on NVIDIA's price-to-earnings (P/E) ratio of 35 times for 2019 and early 2020, he set a target price of $135 for NVIDIA, which is 5% higher than Wednesday's closing price. Ferragu further pointed out that NVIDIA's P/E ratio could decline, as its current stock price is 40 times the expected earnings for the next 12 months, whereas it had dropped to 20 times when the growth slowed to 10% in 2019.

Nevertheless, he believes that the company's fundamental quality remains intact, and he would consider buying again only when NVIDIA's stock price continues to be sluggish.

Currently, there are very few analysts on Wall Street with a negative view of NVIDIA. According to data from TipRanks.com, out of 41 analysts, 38 recommend buying NVIDIA's stock, three suggest holding, and none advise selling. This year, only Germany's DZ Bank downgraded NVIDIA's rating from buy to hold in May.

Despite the overwhelming optimism from almost all analysts towards NVIDIA, New Street Research goes against the trend and is one of the few analysts with a bearish outlook on NVIDIA.

Thanks to the launch of ChatGPT at the end of 2022, which sparked a surge in AI technology, NVIDIA's stock price has risen by 159% this year. However, NVIDIA's stock price has receded in recent weeks as some investors choose to lock in profits. Overnight on Friday, NVIDIA's stock closed down nearly 2%.Contrary to NVIDIA, New Street has a positive outlook on AMD and TSMC, citing their strong growth trends and attractive valuations. In a report, New Street stated:

"AMD and TSMC are the best investment choices in the industry. Both companies have robust upside potential in both the base case (normal market conditions) and the high case (exceptionally strong market performance). Additionally, Broadcom, Arista Networks, and Micron Technology are also 'attractive' in terms of valuation."

Moreover, NVIDIA has garnered attention from regulatory authorities in many countries due to its flagship product H100, which has a "massive" market share exceeding 80%, making it the preferred choice for major data centers. For instance, NVIDIA is facing potential regulation from the European Union.

During a visit to Singapore for an AI conference, Margrethe Vestager, the Executive Vice-President of the European Commission and Competition Commissioner, warned of serious bottlenecks in NVIDIA's AI chip supply. She stated:

"The EU is considering whether to take action against NVIDIA, but it is currently at a preliminary stage, with no actual regulatory actions taken yet."

Earlier this week, it was reported that France plans to initiate antitrust litigation against NVIDIA, accusing it of leveraging its market dominance and expressing concerns about the AI industry's deep reliance on CUDA programming tools. Last year, the French Minister pointed out that NVIDIA's dominance in the AI chip market has exacerbated international inequality, suppressing market competition, with data showing that 92% of the GPU market is occupied by NVIDIA.

Analysts believe that the EU's antitrust actions reflect concerns about the dominant position of American tech giants in new technology fields. The lack of investment and R&D by European companies has led to a slower growth pace compared to the United States.

Join the Discussion